ADA, Inpulse and the Grameen Crédit Agricole Foundation joined forces in 2020 to monitor and analyse the effects of the COVID-19 crisis on their partner microfinance institutions around the world. This monitoring was carried out periodically throughout 2020 in order to gain a better vision of the development of the crisis at the international level. We are extending this work this year on a quarterly basis. The conclusions set out in this article follow the first quarter of 2021. With this regular analysis, we hope to contribute, at our level, to the charting of strategies and solutions adapted to the needs of our partners, as well as to the dissemination and exchange of information by and between the different stakeholders in the sector.

In a nutshell

The results presented in the following pages come from the sixth survey (1) of the joint ADA, Inpulse and Grameen Crédit Agricole Foundation series. The responses from our partner microfinance institutions were collected in the second half of April 2021. The 87 institutions that responded are located in 47 countries in Eastern Europe and Central Asia (EECA-25%), Sub-Saharan Africa (SSA-29%), Latin America and the Caribbean (LAC-25%), South and Southeast Asia (SSEA-13%) and the Middle East and North Africa (MENA-8%) (2).

Whereas the general improvement in the local contexts relating to COVID-19 enables microfinance institutions to conduct their activities better, our latest survey shows that MFIs nevertheless had a lot of difficulties in reaching their development goals in the first quarter of 2021. The reasons cited have mainly to do with the difficulties encountered by the customers of the MFIs. Such customers are reluctant to commit to new loans, and if they do, it is for smaller amounts than in the past. At the same time, their risk profile has deteriorated due to the crisis and the MFIs will find it more difficult to finance them.

This general trend of increasing risk has led to a decline in the quality of the portfolio of the MFIs. In 2020, it has ultimately been reflected in the profit and loss accounts of institutions with an increase in provisioning expenses. This is likely to be the case again this year, with additional reserves but also loan write-offs.

In fact, the operations of the MFIs have been reduced or slowed down, generally with a decrease in the level of their equity capital. In point of fact, one in two MFIs, irrespective of size, indicates a need for capital in 2021. Two trends emerge: the MFIs are counting on their current shareholders to cover the losses linked to the crisis. Conversely, international investors are expected to support their development as of this year. The answers provided by our partners therefore underscore the need for recapitalization this year, which will involve all the players in the sector.

1. Disbursement levels are still low notwithstanding the reduction in constraints

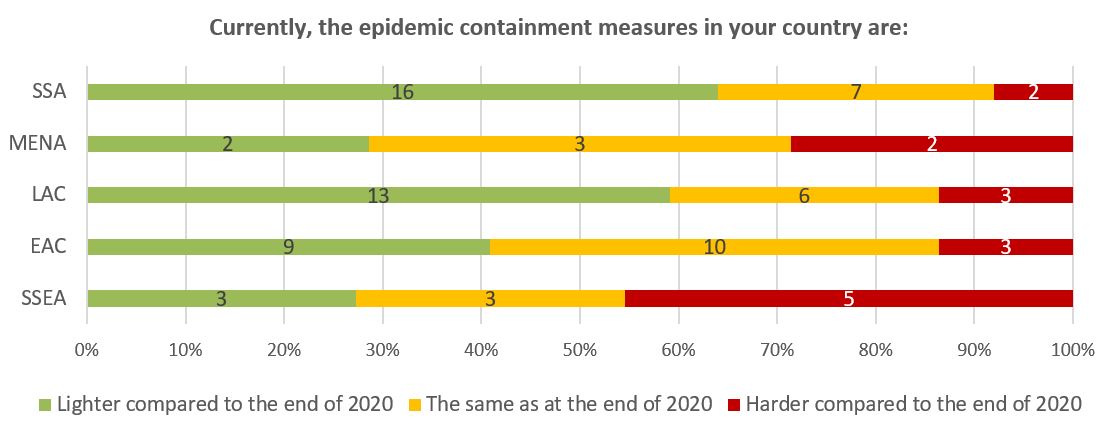

Whereas we have seen a gradual but definite reduction in operational constraints for MFIs since the summer of 2020, this phenomenon continues in the first quarter of 2021. 50% of MFIs in all indicate that the measures in place in their countries are less constraining in April compared to the end of 2020. This is particularly pronounced in Sub-Saharan Africa (64% of respondents in the region) and Latin America and the Caribbean (59%). This is to a lesser extent true for MFIs in Europe and Central Asia, where the situation is either improving or stable. Finally, the situation is opposite in South and South-East Asia, with 45% of respondents in the region reporting a more difficult context, with the Cambodian and Burmese situations weighing on results.

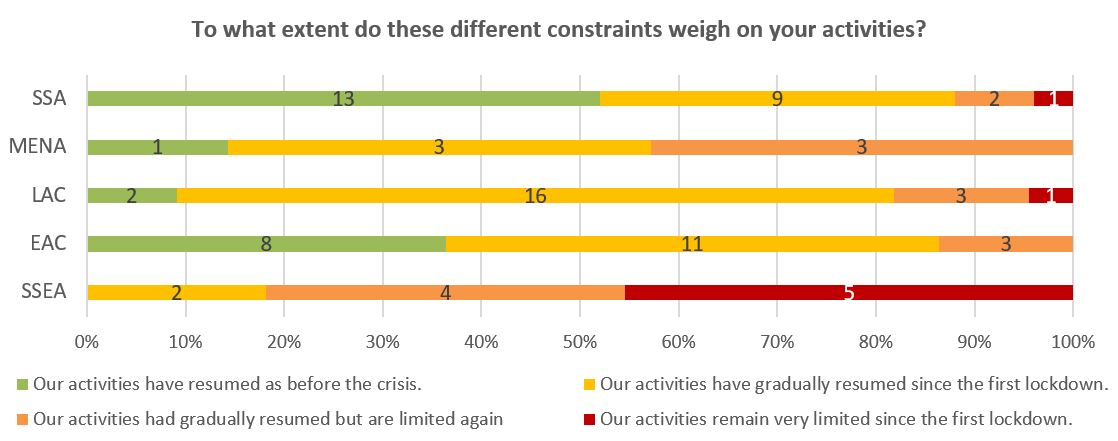

Almost half of the respondents overall report that they no longer face any operational constraints in conducting their activities. This is reflected in the resumption of activity by the MFIs: 52% of those in sub-Saharan Africa can work as before the crisis. The vast majority of MFIs in Latin America are gradually resuming their activities since the first difficulties encountered. The situation in Europe and Central Asia is again divided between gradual or almost complete recovery. Conversely, the deteriorated context for MFIs in the SSEA region is reflected in activities that are either still constrained or are again affected by new measures to contain the epidemic.

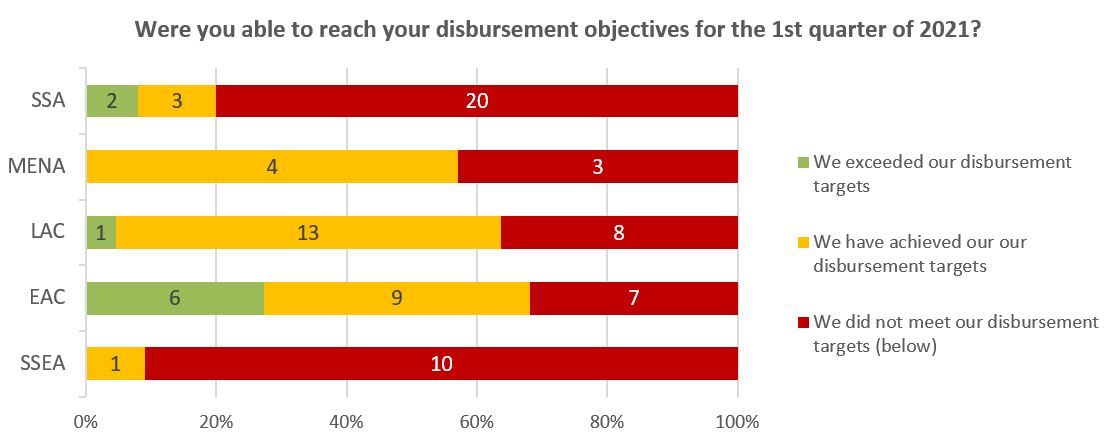

Despite these continued positive signals on the level of activity of our partners, the expected level of loan disbursement for the quarter is apparently still difficult to achieve. For example, 55% of respondents report that they did not meet their loan disbursement targets in the first quarter of 2021. Only 10% of respondents exceeded their expectations, while 35% managed to meet their targets. The responses do not appear to pertain solely to business recovery: for example, 80% of MFIs in Sub-Saharan Africa did not meet their disbursement targets in the first quarter, while half report a return to near pre-crisis levels of activity.

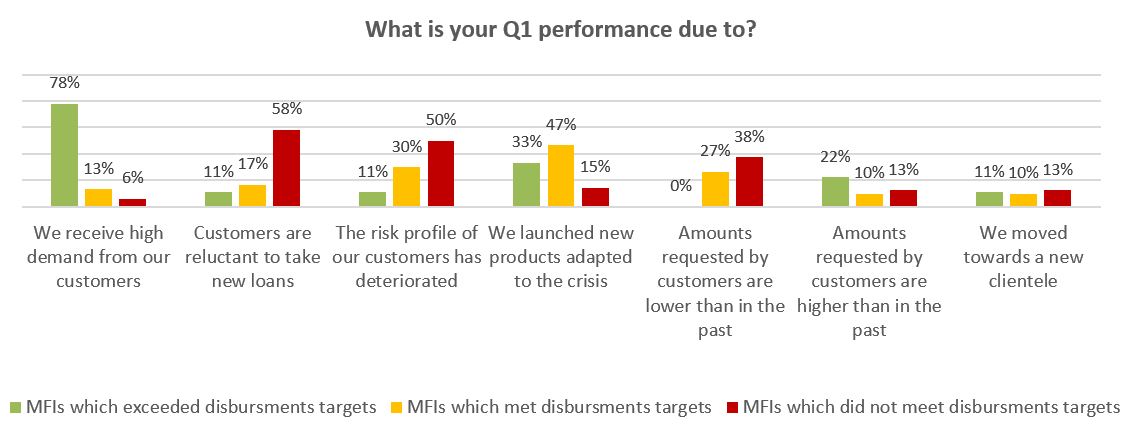

When the MFIs did not meet their growth targets at the beginning of the year, three reasons stand out to explain this phenomenon. Firstly, the fact that customers are still reluctant to take out new loans (58% of this group), especially in a still rather uncertain context. Secondly, this is explained by the deteriorating risk profile of customers (50%), who are no longer eligible for loans or are eligible for smaller amounts (38%).

The latter two arguments are also mentioned by MFIs that have reached their targets without exceeding them. Nevertheless, this dynamic is partly offset by the fact that institutions have adjusted to the crisis and have put in place products adapted (digital, targeted sectors, etc.) to the current contexts in order to meet demand (47%).

Finally, the trend is quite different for MFIs that have exceeded their disbursement targets: the main factor is the strong demand received (78%), while the adjustment of the offer (33%) and the increase in the amounts requested (22%) support this trend.

2. A persistent high credit risk continues to have a significant impact on institutions’ profitability

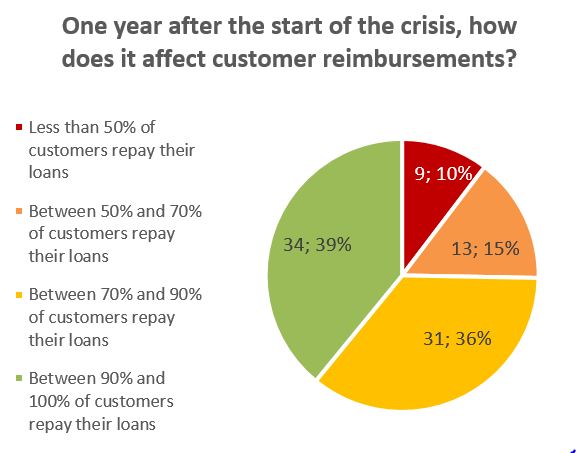

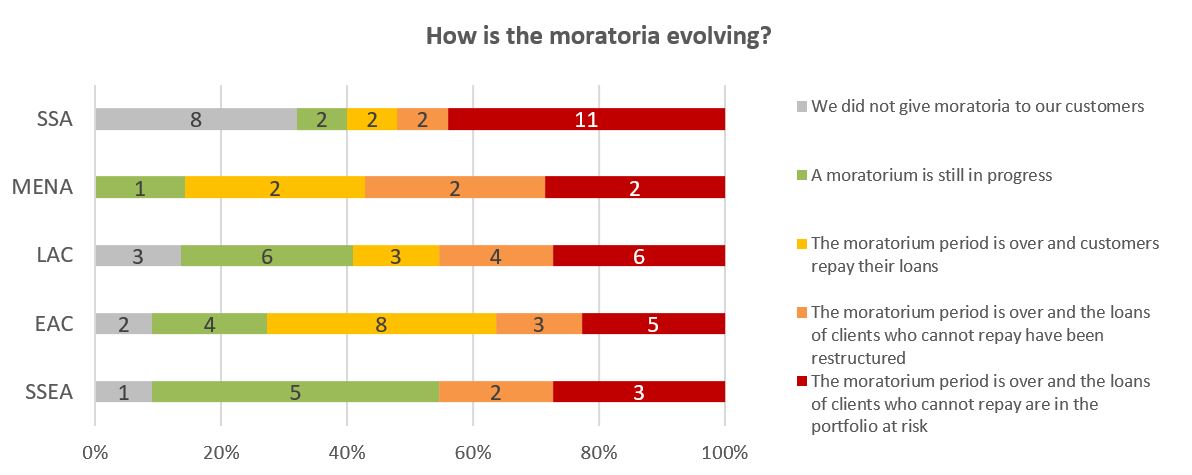

In parallel to these loan disbursement issues, credit risk remains the major challenge for 64% of our partner MFIs, as we have noted since the beginning of our survey series. While late repayments by customers may still be the result of ongoing moratoria (20% of respondents, particularly in South and Southeast Asia and Latin America and the Caribbean), the majority of moratoria exits have resulted in a shift from the “moratorium” portfolio to the “at risk” portfolio, either as unpaid loans or as restructured loans. In total, 61% of the respondents indicate that fewer than 90% of their customers are repaying their loans, and 25% are concerned by repayment rates below 70%.

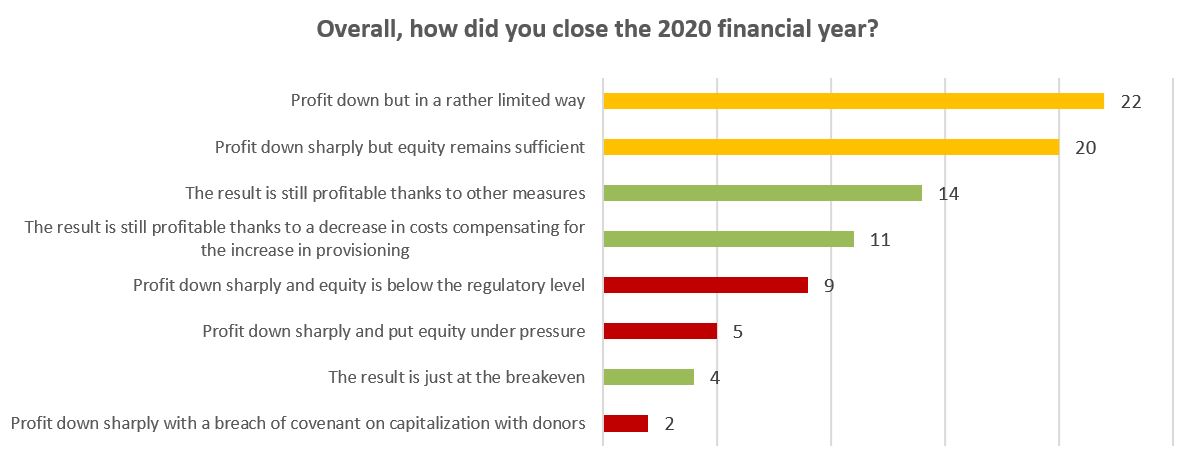

Another major difficulty is the decline in profitability of MFIs since the beginning of the COVID-19 crisis. At the end of Q1 2021, 55% of our partners raise this point. More specifically, we find that a share of the respondents managed to maintain some profitability in 2020, thanks to certain measures (33% – shown in green in the graph below). We then find a group of institutions (49% – shown in orange) for which an impact on profitability has been felt, but without endangering the institution. Finally, a last group stands out (18% – shown in red), in a less favourable position since the losses incurred in 2020 have direct consequences on the institutions’ own funds. For some of these institutions, this even implies that the company’s capital falls below the minimum levels required by the regulator or financiers.

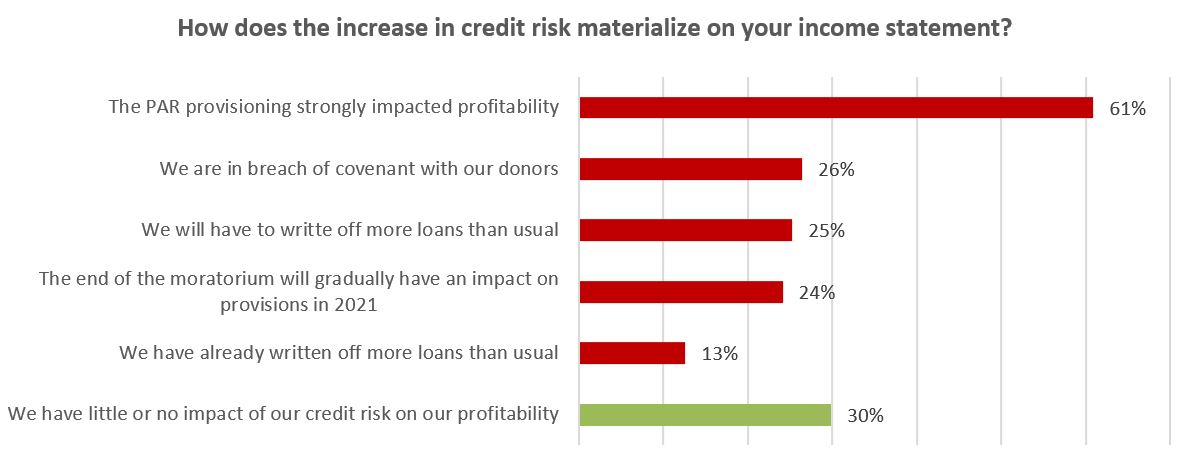

The provisioning of the portfolio at risk turns out to be the main factor impacting on profitability in fact (61%). For some institutions (26%), this may moreover have led to a breach of contract with their funders. At the same time, there are still few massive loan write-offs, as only 13% of respondents have already resorted to debt cancellation to a greater extent than in previous years.

The impact of credit risk on the profitability of the MFIs is nonetheless expected to continue in the coming months. Loan write-offs in high proportions, above the usual standards, should concern 25% of our partners surveyed. At the same time, 24% expect that the provisioning of the PAR, notably through the exit of the moratorium, will continue to have a strong impact on their financial results. Finally, it should be noted that the ageing of the current portfolio at risk could also lead to additional provisioning expenses.

3. Strained equity capital leads to a search for investors

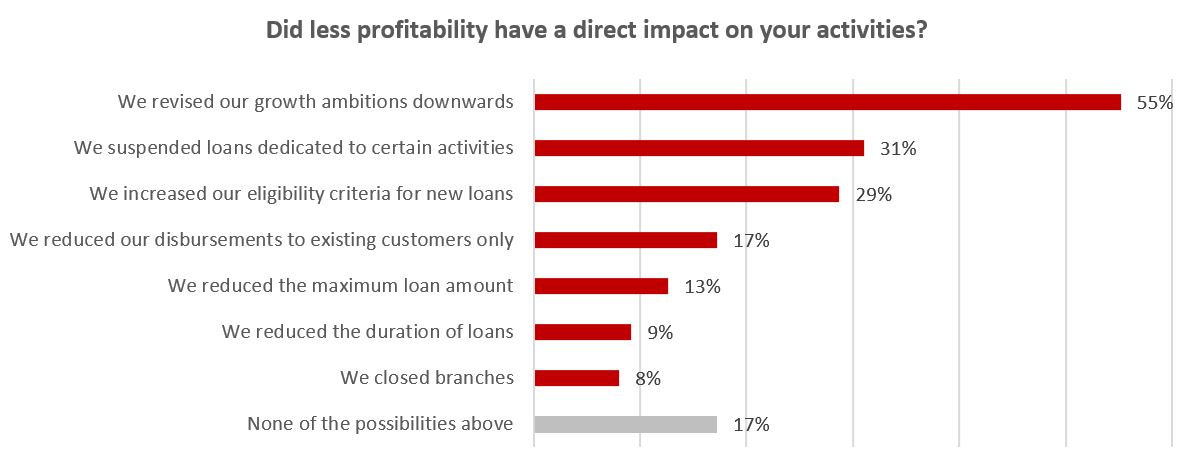

The decline in profitability, which could consequently continue in the near future without any improvement in credit risk, must be analysed for the short and long term. In the short term, controlling the portfolio at risk is a major challenge to avoid a (further) deterioration of profitability. This then has a direct impact on the operations of the MFIs. According to our partners, this observation has led the majority of the MFIs to revise their growth projections downwards (55%) for the coming years. It is also apparent that risk management involves paying particular attention to the type of activity of clients (31% have suspended disbursements to certain sectors – often tourism, international trade, etc.) and to eligibility criteria (29%). This increased caution reflects the current emphasis on risk management.

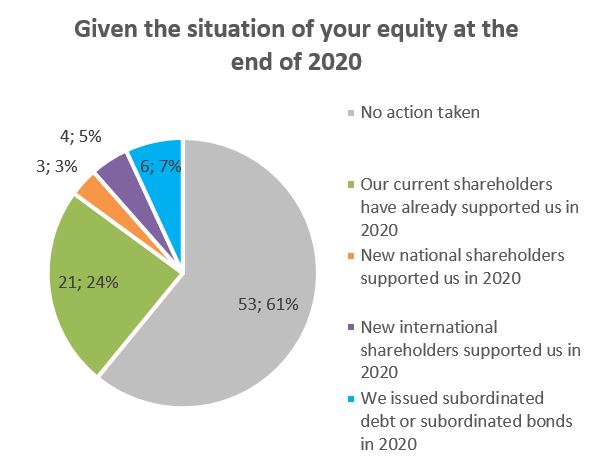

The other angle of reflection for the longer-term is the solvency of microfinance institutions in the face of declining revenues or losses. A majority of institutions today (61%) have not taken any action regarding their capital since the beginning of the crisis. Where this has been the case, existing shareholders have provided support to the MFIs, while subordinated debt (Tier 2 equity capital) has also been put in place, to a lesser extent.

The other angle of reflection for the longer-term is the solvency of microfinance institutions in the face of declining revenues or losses. A majority of institutions today (61%) have not taken any action regarding their capital since the beginning of the crisis. Where this has been the case, existing shareholders have provided support to the MFIs, while subordinated debt (Tier 2 equity capital) has also been put in place, to a lesser extent.

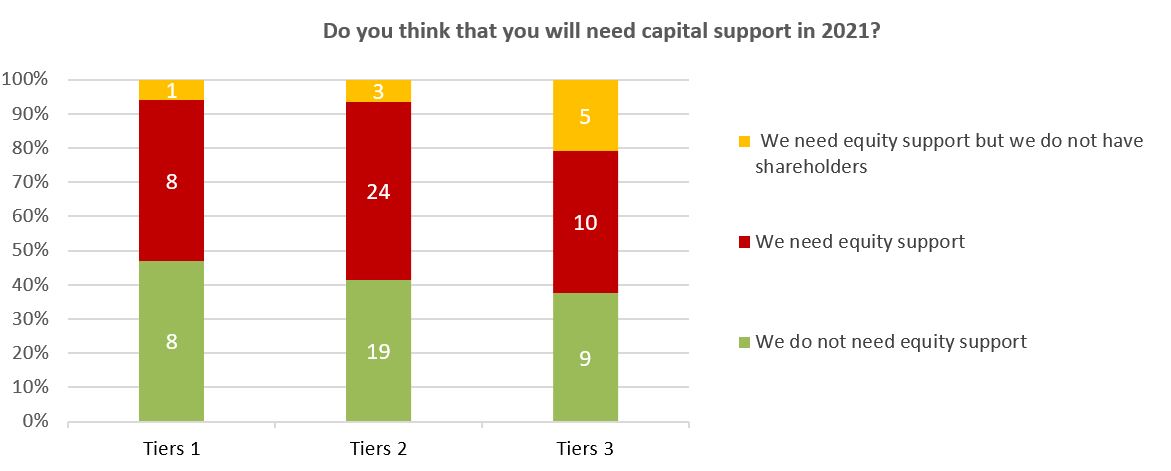

A very high proportion of these institutions (48%) nonetheless report an equity requirement in 2021. This sizeable proportion shows the extent of support needed within the sector to ensure its development. There is no real archetype of MFI that emphasizes this expectation of capital support in 2021: regardless of the size of the MFI, about half of each Tier category expresses capital needs.

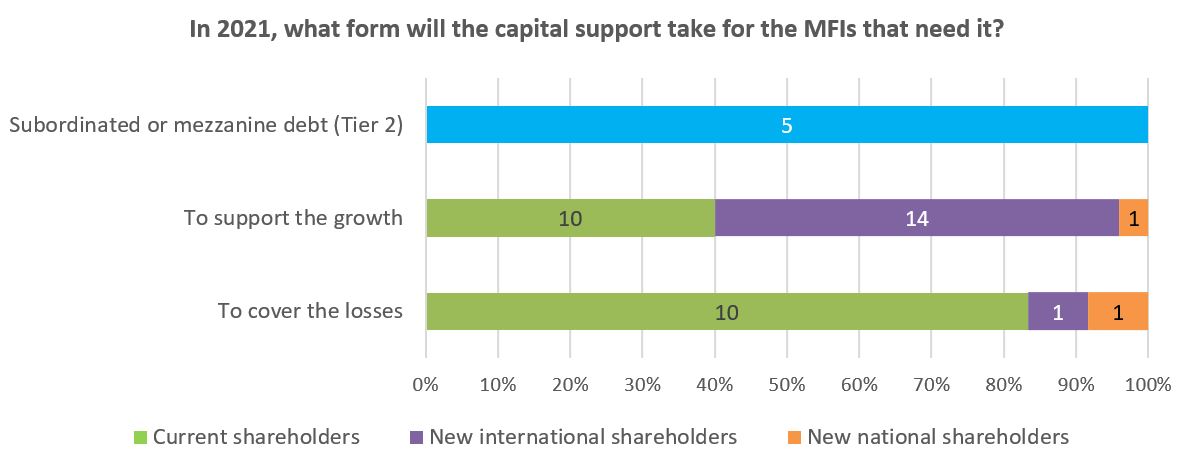

To meet these capital expectations, The types of shareholders that microfinance institutions wish to turn to in order to meet these capital expectations depend on the reason why this support is needed. For example, for institutions that mention a need for equity support in 2021, we find that when an MFI needs help to cover losses, it overwhelmingly turns to its existing shareholders (83% of cases, 10/12). Conversely, when MFIs are looking for support to continue to grow, they will more often turn to international investors (56% of cases, 14/25), beyond the potential contribution of existing shareholders. Finally, it is worth noting that subordinated debt may be favoured over capital injection, as this option is mentioned by 5 institutions.

All of our partners’ responses therefore suggest that the impact of the crisis, through credit risk, logically creates equity needs for a large proportion of entities, as they face either financial losses or a limitation in their ability to recover. While 41% of respondents say they will focus on improving the quality of their portfolio this year, our partners remind us of the essential role that international and existing investors will have to play in maintaining a satisfactory level of capitalisation that is conducive to their development.

_________________________________________________________________