Crédit Agricole Group

Created in 2008, with a 50 million euro endowment from Crédit Agricole SA, the Foundation, by virtue of its status and its proximity to regional entities and Banks, constitutes a pole of financial innovation which promotes the development of cooperation in favor inclusive and sustainable finance within the Group.

![]()

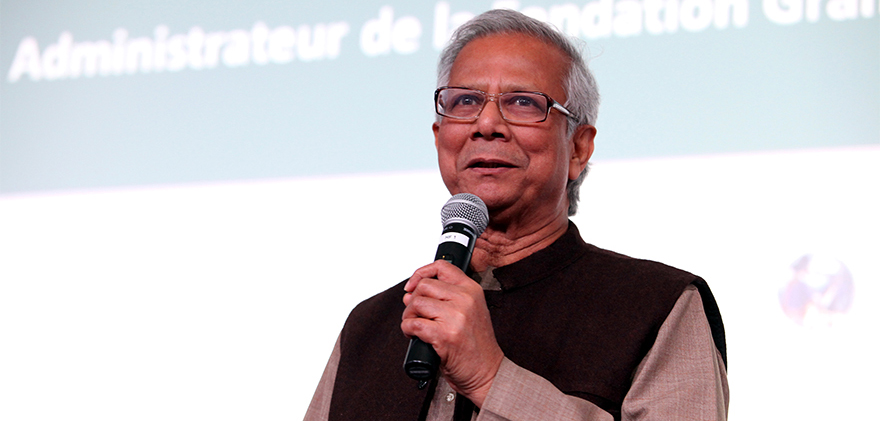

The Foundation was co-founded by Professor Yunus, founder of the Grameen Bank – the first microfinance bank – and Nobel Peace Prize winner 2006. With the Foundation, the Grameen network is expanding its activities and exploring new forms of inclusive finance.