The Covid-19 Observatory is a space dedicated to articles related to the Coronavirus, as well as to the results of the Foundation’s investigations and analyzes around the impact of the crisis on the microfinance institutions supported.

You will also find all the information relating to the joint commitment signed by a group of donors and microfinance platforms to support microfinance institutions and their clients in the face of the Covid-19 crisis.

Pledge to reinforce microfinance

The Foundation publishes the 2nd edition of “Taking the Floor”

11

The Grameen Crédit Agricole Foundation has been promoting financial inclusion and social entrepreneurship for thirteen years now and continues to work in favour of the development of rural areas and female entrepreneurs. At the end of 2021, the Foundation had accumulated nearly €300 million in funding, 379 technical assistance missions in progress or completed and 136 organisations funded.

We are pleased to share with you this second edition of “Taking the floor”. It presents our daily support for entrepreneurs, rural communities, refugees and farmers. Enabling refugees from the Nakivale camp to access credit in Uganda, modernising agricultural practices in Moldova, financing access to water and ensuring the pay of breeders in Senegal, these are some of the actions highlighted in this second edition.

These stories demonstrate the resilience of the microfinance sector, this ability to cope with the health context, the economic difficulties and the effects of global warming. Resilience also refers to the ability to transform obstacles into opportunities to strengthen oneself. The digital transformation, the coordination between stakeholders and the innovation demonstrated by our partners throughout these last difficult months are a clear proof of it.

The Grameen Credit Agricole Foundation in 2021

Eric Campos, Fondation Grameen Crédit Agricole

In 2021, the Grameen Crédit Agricole Foundation supported 81 microfinance institutions and social enterprises in 37 countries. In the context of the Covid-19 crisis, the Foundation supported its partners with funding and technical assistance. Spotlight on the interview with Eric Campos, Managing Director of the Foundation and CSR Director of Crédit Agricole SA.

How did you support microfinance institutions?

Contrary to what we thought, the entire year of 2021 was marked by the Covid crisis and the economic effects and measures taken by the States to protect the population. The Foundation therefore intervened in three ways with the partners. First, we have maintained a fairly high volume of financing, with 45 million Euros lent to microfinance institutions. We also granted deferrals, to give institutions a break, to allow them to deal with their own deferrals that they granted to their beneficiaries. Finally, we have increased our capacity, our coordination in terms of technical assistance since, and this is a record, we have coordinated 130 technical assistance missions, mainly to support institutions in terms of risks, counterparty risks, strengthening their risk team, their organisation, and also in terms of managing their cash flow.

How is the microfinance sector doing at the end of 2021?

2020 was a Covid year and the institutions coped, knew how to deal with this systemic crisis. 2021 has been tougher. They had been a little exhausted by this first year of 2020 and they had to pursue their efforts, their resistance. And therefore, the Foundation was indeed able to support these institutions, but some difficult cases appeared for which it was necessary to grant not only deferrals but also restructurings.

It is important to say that the entire microfinance sector, foundations, investment funds, were able to talk to each other to provide the best possible support to the institutions that were experiencing the most significant difficulties. The sector is still resilient. It is an attractive sector. We can say that it has faced this systemic crisis with a resilience that was probably even greater than what we thought.

What is the Foundation’s agenda for 2022?

2022 will be the year of preparation for our 2022-2025 medium-term plan. It will hinge on this climate crisis that is hitting the Foundation’s areas of intervention hard.

Better support rural populations, strengthen their economic resilience, in the aftermath of an extremely serious economic crisis; this will be the first axis on which we will work. And the second one is to support the most vulnerable populations, those who have also suffered from this economic crisis and who need us to be able to support them in accessing financing, in the development of income generating activities. These will be the two pillars of our 2022-2025 medium-term plan.

€10 million partnership in favour of African entrepreneurship between EIB and the Foundation

16 February, 2022

Small entrepreneurs across Africa to benefit from €10 million partnership between European Investment Bank and the Grameen Credit Agricole Foundation

- Ongoing cooperation to strengthen access to microfinance by rural and underserved entrepreneurs impacted by COVID pandemic

- Scheme to back microfinance institutions in different countries across Africa, with a focus on gender inclusion

- Africa private sector to benefit from local currency financing and support for smaller microfinance institutions

Access to finance by entrepreneurs and businesses impacted by COVID-19 in rural regions in Sub-Saharan countries will be enhanced by a new €10 million targeted financing initiative launched by the European Investment Bank (EIB) and the Grameen Credit Agricole Foundation ahead of the first EU-Africa summit since the pandemic.

The latest cooperation between the European Investment Bank, the world’s largest international public bank and the Grameen Credit Agricole Foundation, a leading supporter of microfinance across Africa, will focus on ensuring that small business can access finance, create jobs and combat poverty.

“Ensuring that entrepreneurs and communities across Africa can access finance is essential to unlock opportunities, accelerate social inclusion and strengthen economic resilience to challenges unleashed by the COVID-19 pandemic. The EIB is committed to supporting microfinance across Africa and we are pleased to strengthen over long-standing cooperation with the Grameen Credit Agricole Foundation. The €10 million engagement launched today will directly benefit small businesses across the continent.” said Ambroise Fayolle, Vice President of the European Investment Bank.

“Delivering targeted financing in fragile regions is capital to beat poverty, prevent social exclusion and unlock opportunities that drive economic growth. This new cooperation between the EIB and our Foundation will strengthen access to finance by entrepreneurs in sectors impacted by COVID and in remote and rural communities.” said Eric Campos, Managing Director of the Grameen Credit Agricole Foundation.

The new pan-African microfinance partnership was formally agreed in Brussels earlier today ahead of the EU-Africa Summit at the EU-Africa Business Forum.

Improving private sector access to finance in disadvantaged communities

The new cooperation between the EIB and the Grameen Credit Agricole Foundation will help to scale up microfinance activity across Africa by providing long-term and local currency financing to local microfinance institutions.

The investment is expected to finance more than 147,000 loans to self-employed and micro-enterprises, alongside sustaining up to 36,000 jobs. Reflecting the importance of empowering women and girls across Africa the scheme will support an estimated 98,000 loans to female entrepreneurs.

Tackling challenges holding back microfinance in Africa

The new operation will support smaller microfinance institutions than those that the EIB can finance directly. These microfinance partners are often also unable to receive financing from local commercial banks and cannot scale up.

The initiative will benefit financial and social inclusion and is expected to support entrepreneurs in remote regions, micro business run by women and young people who have limited or no access to financial services. This vulnerable and underserved segments are also the most impacted by the COVID-19 pandemic.

Supporting fragile regions across Africa

The Grameen Credit Agricole Foundation will be able to allocate the loan across the many microfinance institutions in sub-Saharan Africa. The network of partner microfinance institutions spans sixteen countries across the region, including fragile ones such as Benin, Togo, Niger and Malawi.

Building on longstanding cooperation between microfinance partners

The European Investment Bank and the Grameen Credit Agricole Foundation have worked together to strengthen microfinance across Africa since 2018 and strive to enhance microfinance best-practice and help entrepreneurs to improve business skills through technical assistance projects.

The European Investment Bank is the world’s largest international public bank and since the pandemic has provided more than €8 billion for new investment across Africa.

The European Investment Bank (EIB) is the long-term lending institution of the European Union owned by its Member States. It makes long-term finance available for sound investment in order to contribute towards EU policy goals.

Created in 2008 at the joint initiative of Crédit Agricole and Nobel Peace Laureate Pr. Muhammad Yunus, the Grameen Crédit Agricole Foundation finances and supports through technical assistance microfinance institutions and social enterprises in around 40 countries.

Covid-19: Crisis evolution in some of our countries of intervention

Since the beginning of the pandemic, the Grameen Crédit Agricole Foundation has been monitoring the evolution of the health crisis in its countries of intervention to better understand its effects on supported microfinance institutions and their clients. After Covid-19: the impact of the crisis on microfinance, this new publication compiles data and analyses from some of the countries where the Foundation works.

The Foundation has chosen to use accessible, quantitative and qualitative measurement tools. The quantitative indicators focus on the number of Covid cases and the number of deaths, which are analysed on average over 7 days and as a proportion of 1 million inhabitants in order to have comparative data. The percentage of fully vaccinated inhabitants is also taken into account to assess the effectiveness of the vaccination campaign in the country. The qualitative measurement tools are based on the government’s actions in response to the crisis, the pandemic’s impact on the economy and the health mapping (red, orange or green countries) developed by the French government.

Sources are exclusively from relevant entities: the European Center for Disease Prevention and Control, International Monetary Fund, French Ministry of Foreign Affairs, French Ministry of Public Health, Organisation for Economic Co-operation and Development, World Bank and World Health Organisation.

With this publication, intended for policy makers, funders, operators and microfinance institutions, we hope to contribute to the understanding of the effects of Covid-19 on the microfinance sector in order to better prepare, innovate and respond to the crisis.

Digital Technology at the Heart of the Strategic Orientations of Microfinance Institutions

ADA, Inpulse and the Grameen Crédit Agricole Foundation joined forces in 2020 to monitor and analyse the effects of the COVID-19 crisis on their partner microfinance institutions (MFIs) around the world. This monitoring was conducted periodically in 2020 and 2021 so as to get a better view of the development of the crisis worldwide. The conclusions presented in this article follow the last study conducted in November 2021. With this regular analysis, we hope to contribute, at our level, to the charting of strategies and solutions adapted to the needs of our partners, as well as to the dissemination and exchange of information by and between the different stakeholders of the sector.

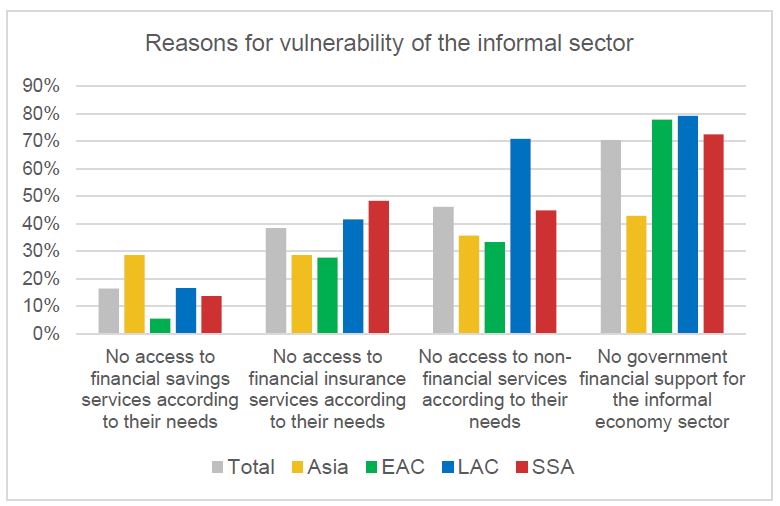

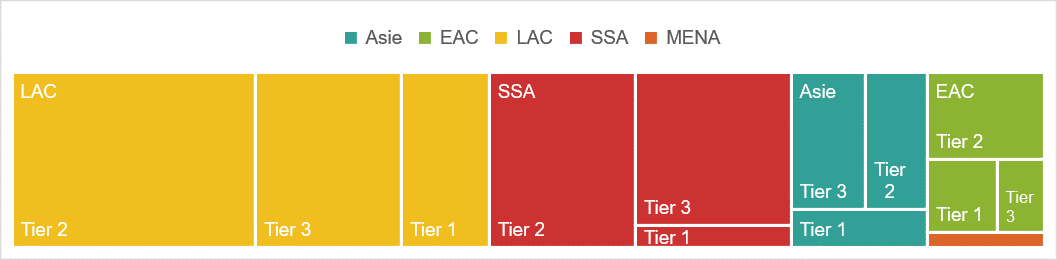

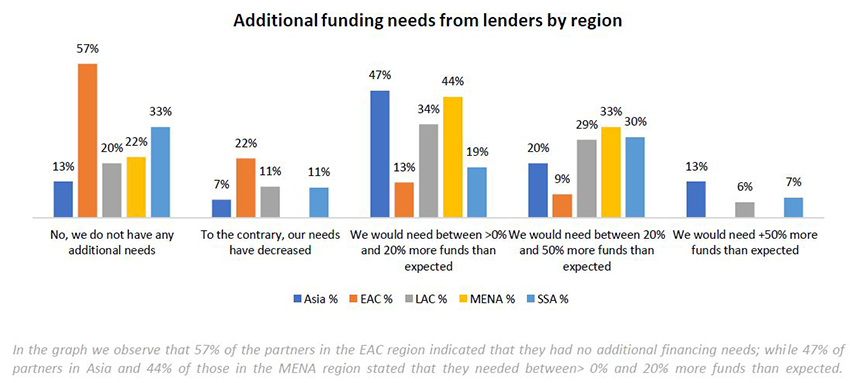

The results presented here are from the 8th survey in the joint series (1) of ADA, Inpulse and the Grameen Crédit Agricole Foundation. The 70 institutions that responded are located in 39 countries in Eastern Europe and Central Asia (ECA-24%), Sub-Saharan Africa (SSA-38%), Latin America and the Caribbean (LAC-20%), South and Southeast Asia (SSEA-9%), and the Middle East and North Africa (MENA-9%) (2).

1. Despite the recovery in operations, growth is limited by weak demand

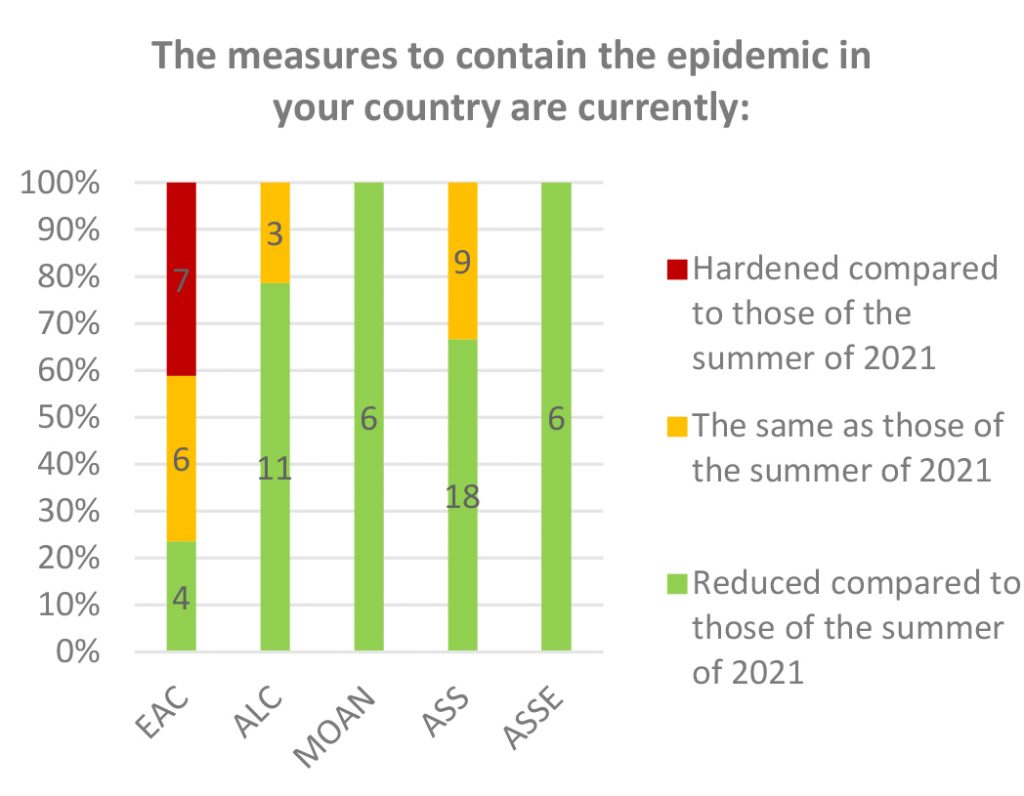

The COVID-19 environment improved substantially for our partner microfinance institutions in the 2nd half of 2021. More specifically, as of November 2021, 64% of them reported that the measures taken to contain the epidemic in their countries had eased compared to those experienced in the summer, and 70% of respondents (49 MFIs) no longer faced COVID-19-related constraints in their operations.

The COVID-19 environment improved substantially for our partner microfinance institutions in the 2nd half of 2021. More specifically, as of November 2021, 64% of them reported that the measures taken to contain the epidemic in their countries had eased compared to those experienced in the summer, and 70% of respondents (49 MFIs) no longer faced COVID-19-related constraints in their operations.

MFIs in Eastern Europe (Bulgaria, Lithuania, Moldova and Romania) stand out as an exception to this dynamic, since some of them (7 MFIs out of 13 in this sub-region) report a hardened context during this period, linked to the resurgence of the epidemic in the region in the last quarter. This is reflected in the difficulties in meeting clients in the field or in branches and therefore in conducting activities in general (collection and disbursement of loans).

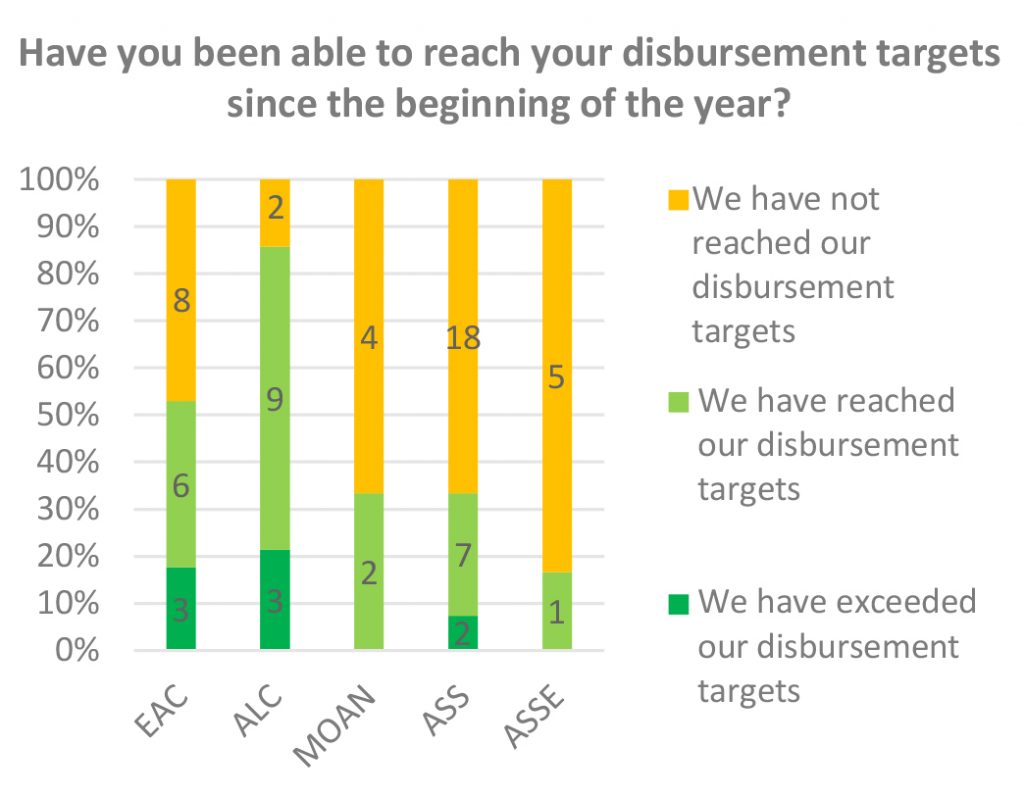

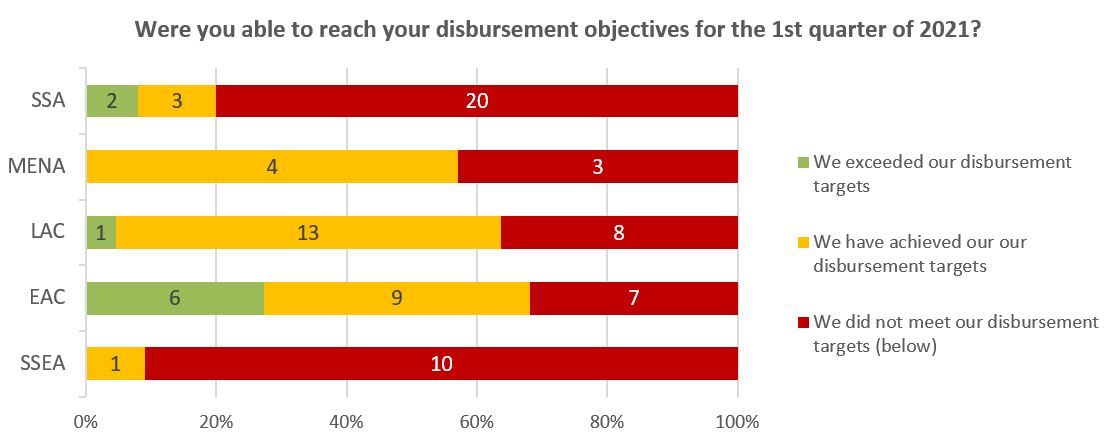

It is in this changing context that MFIs have been operating for almost two years now. Although conditions are improving, operational performance has remained below expectations as the surveys continue: 53% of respondents (37 MFIs) report that they have not met their disbursement targets since the beginning of the year. This phenomenon is encountered globally in every region, with the exception of LAC (where most partners are located in Central America).

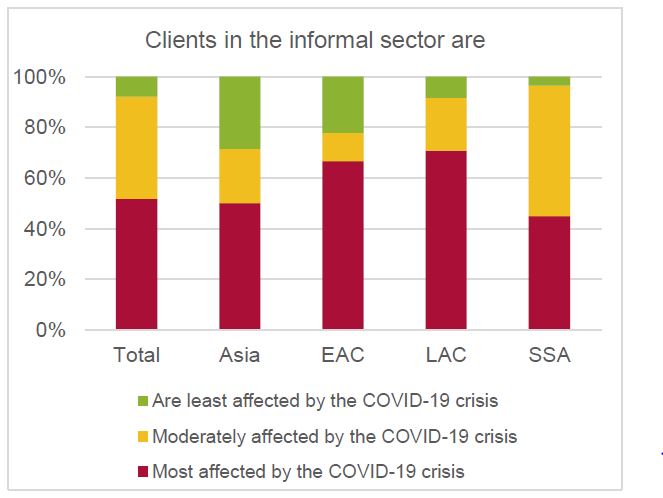

The low levels of disbursements are related first and foremost to difficulties experienced by MFI clients. The two most common reasons given (54% and 49% respectively) for the MFIs that are not growing at the expected levels this year are the deteriorated risk profile of clients and the reluctance of clients to take out new loans. This justification is further confirmed by the fact that 53% of respondents still have a higher risk portfolio than before the crisis. This persistent increase in risk and the situation of a portion of the MFIs’ clients with little or no needs consequently limits the possibilities of MFIs for development.

The low levels of disbursements are related first and foremost to difficulties experienced by MFI clients. The two most common reasons given (54% and 49% respectively) for the MFIs that are not growing at the expected levels this year are the deteriorated risk profile of clients and the reluctance of clients to take out new loans. This justification is further confirmed by the fact that 53% of respondents still have a higher risk portfolio than before the crisis. This persistent increase in risk and the situation of a portion of the MFIs’ clients with little or no needs consequently limits the possibilities of MFIs for development.

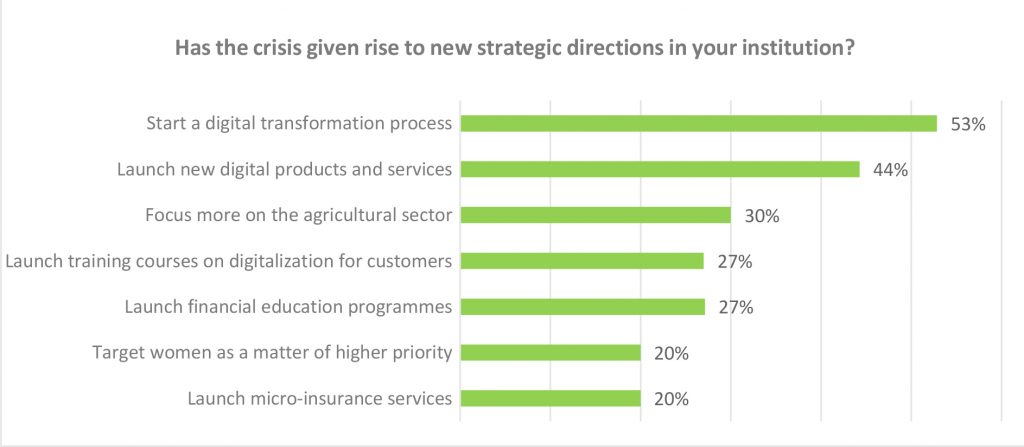

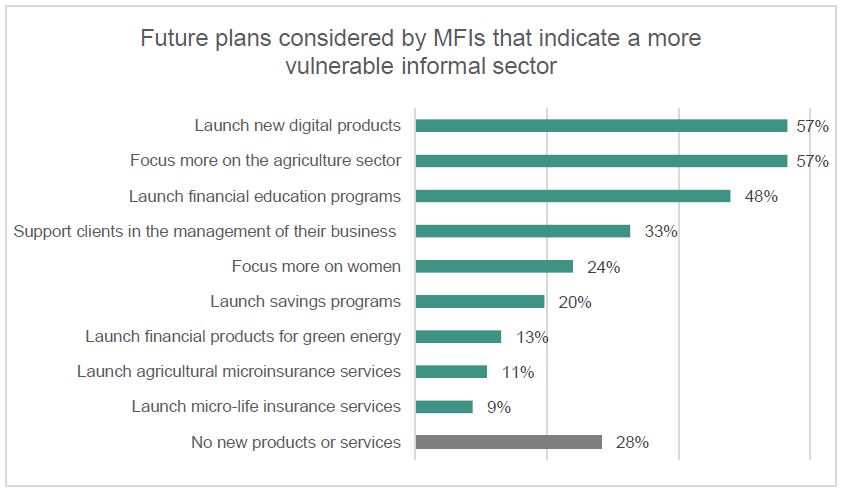

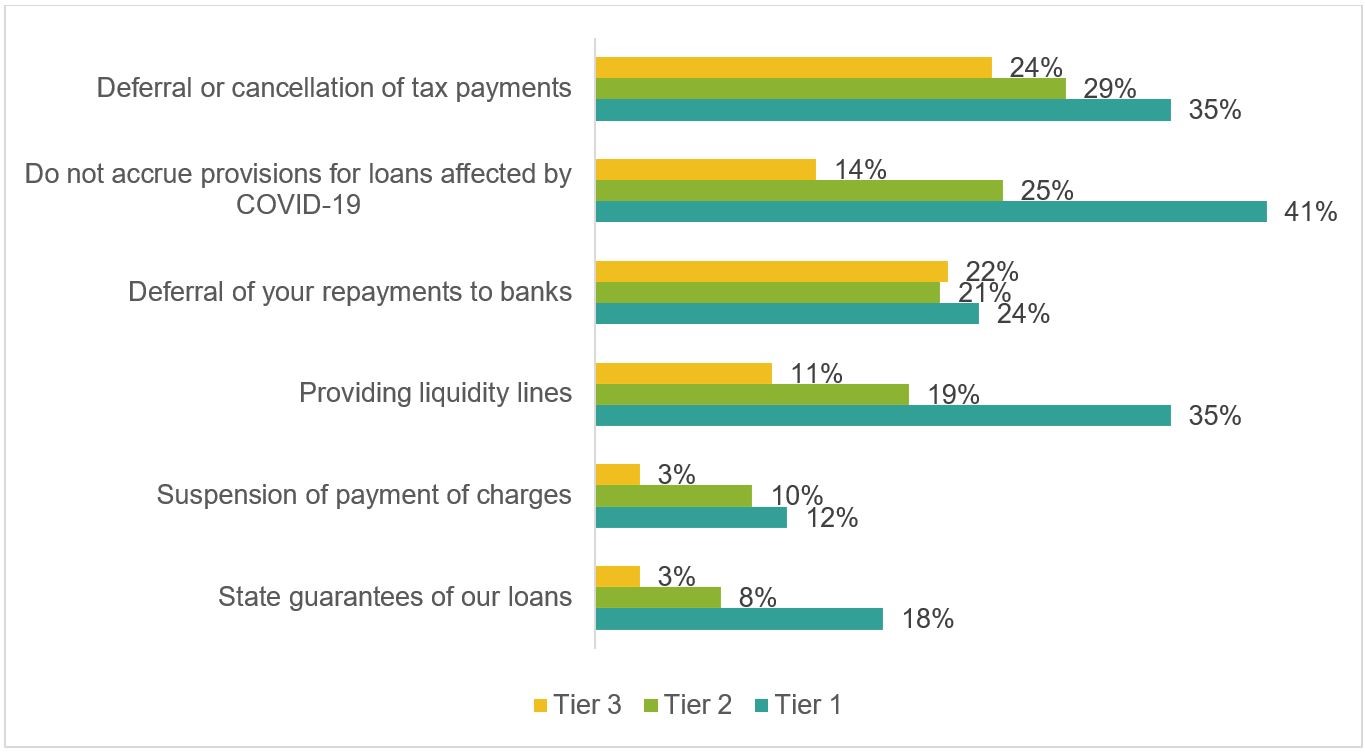

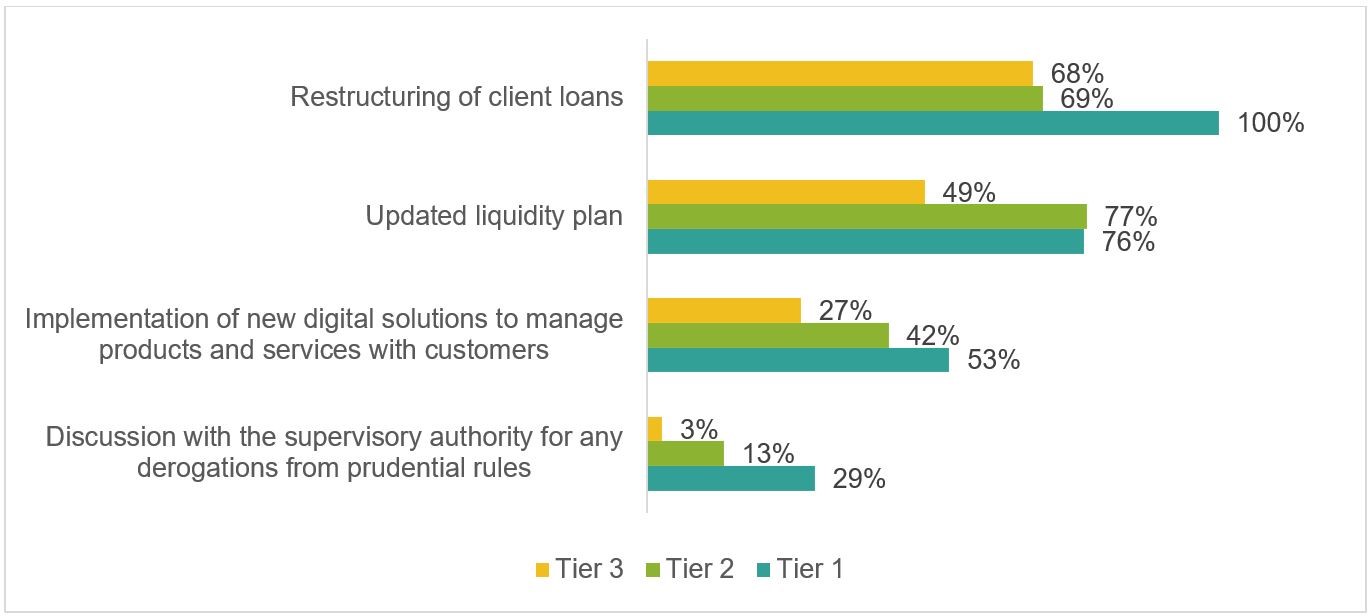

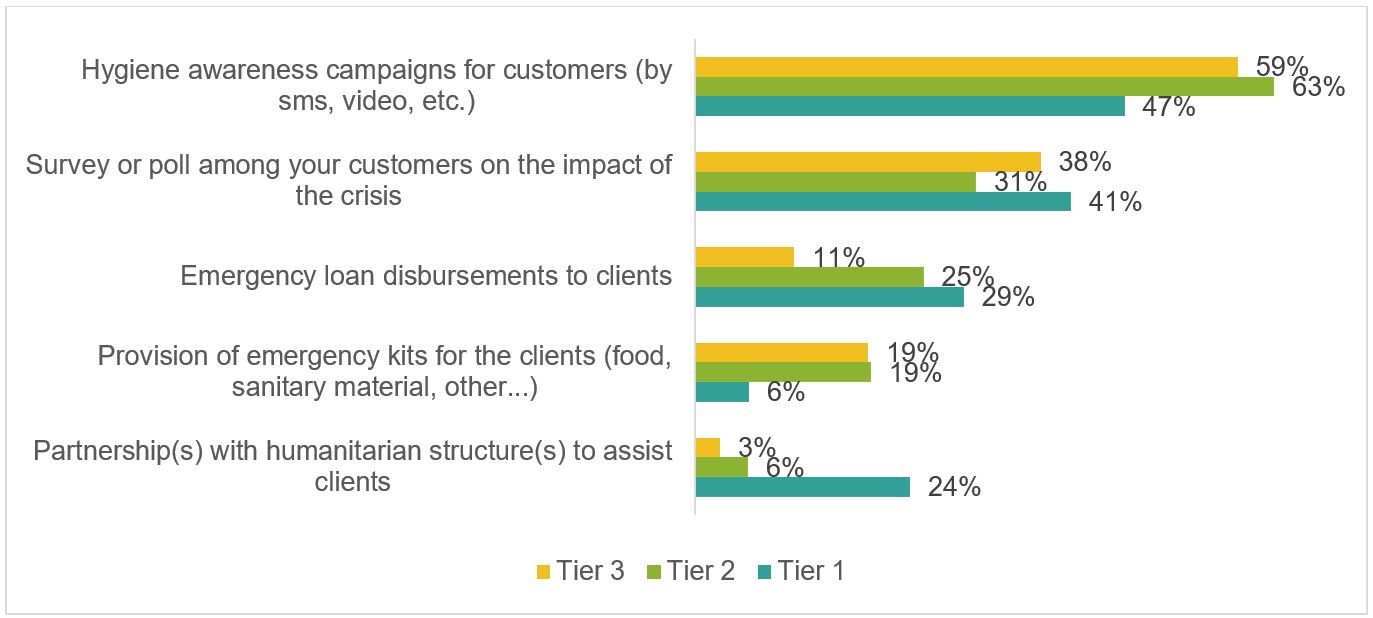

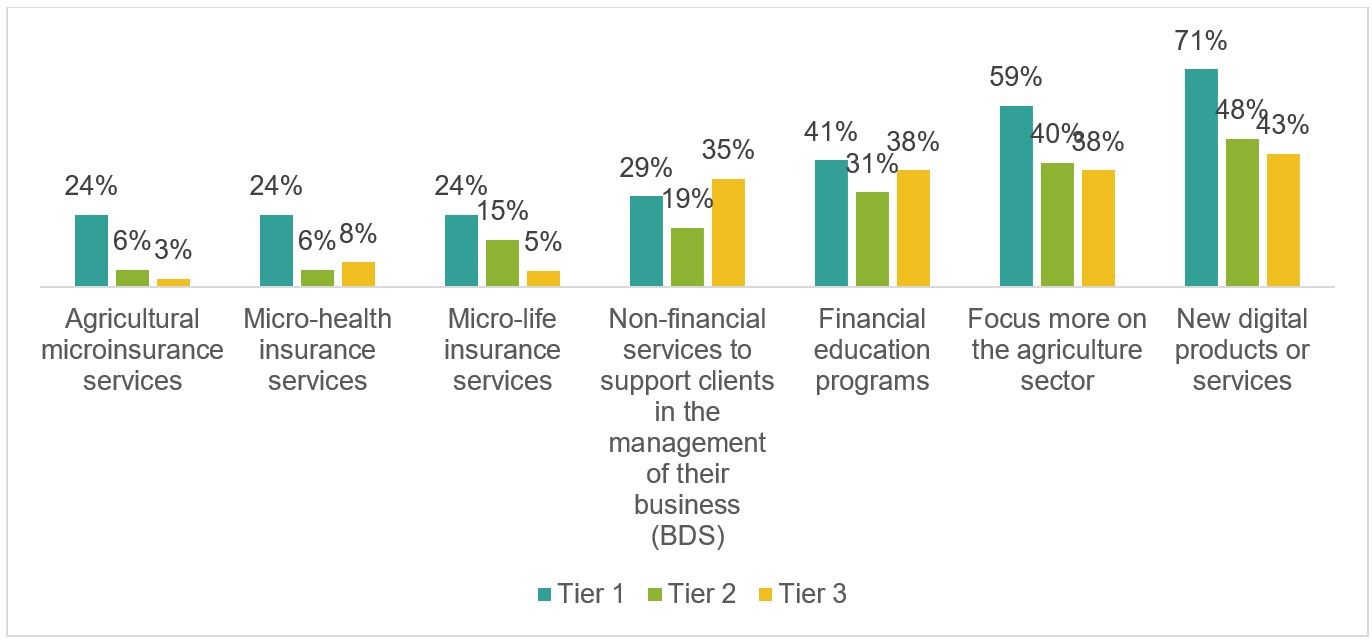

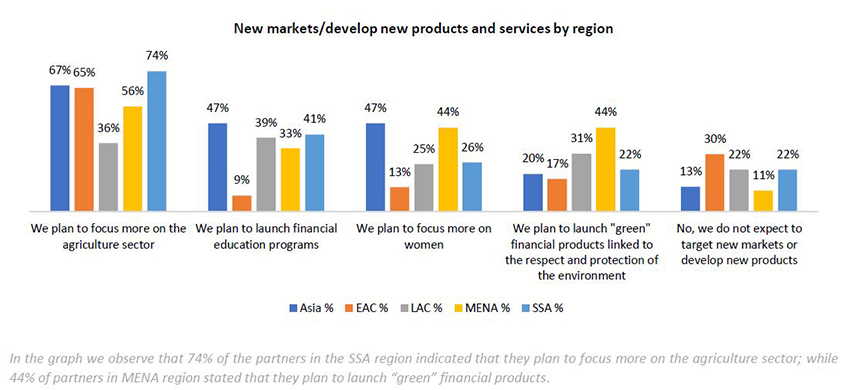

2. Digitalization remains the top priority for microfinance institutions

A gradual and contrasting economic recovery notwithstanding, the proactive approach of MFIs to adapt to current and future challenges continues to be demonstrated as the months go by. We have noticed that the crisis has fuelled reflection on strategic issues since its onset. At the end of 2021, 47% of MFIs confirm that the important areas of work for the coming years have emerged with the crisis. Above all, the topics most mentioned at the beginning of the pandemic (product development for agriculture, adaptation of the offer, digitalization) are still at the heart of the directions that partner institutions should take.

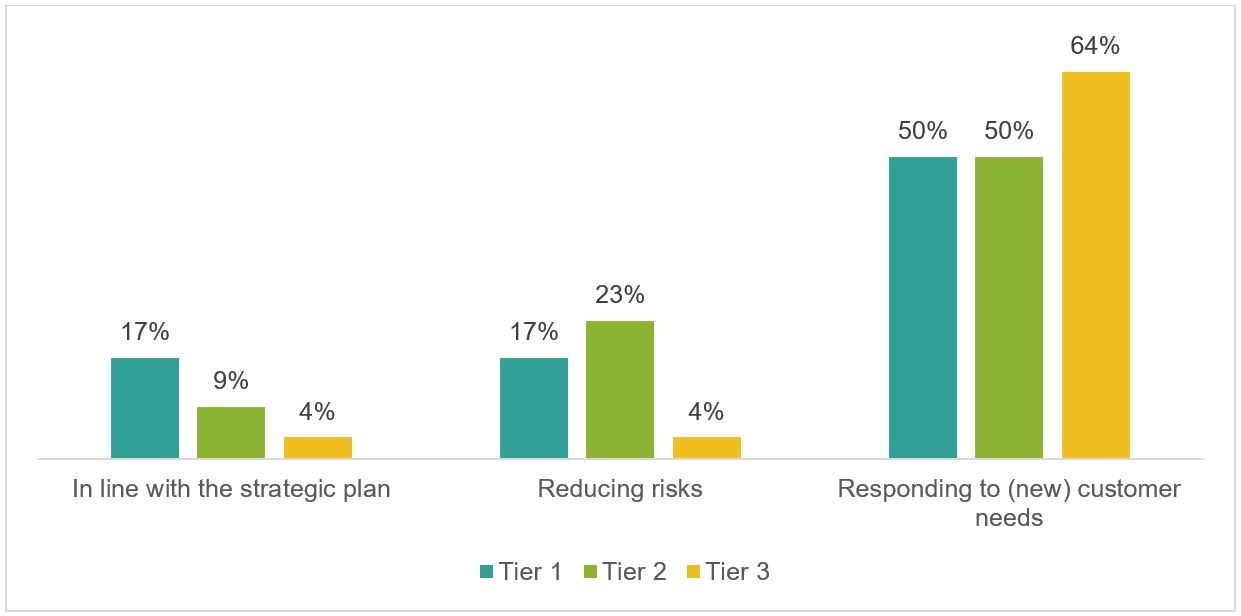

The implementation of (internal and external) digital solutions is considered the main area of development. Digitalization is essential to overcome the difficulties of direct contact with borrowers, a subject that has been highlighted since the beginning of the pandemic. We also note that the appeal of digitalization is found in all regions, but that it is more or less pronounced depending on the size of the MFI: 69% (9 MFIs) of Tier 1 (3) institutions are thinking of launching new digital products and services, while this concerns only 47% (15 MFIs) of Tier 2 and 24% (5 MFIs) of Tier 3 institutions.

The other strategic areas cited are mentioned to a lesser extent. 30% of the respondents nonetheless plan to focus more on the agriculture sector. The responses on this subject do not show a marked correlation either in terms of MFI size or location; only the SSEA region shows a particular interest (67%). This echoes the testimonies we collected a year and a half ago: this sector appeared to be one of the least affected by the COVID-19 crisis. This intention to invest more in the agricultural sector is particularly positive as this sector represents an economic, social and environmental challenge for the years to come.

Finally, another point that stands out among the responses of our partners is the training and awareness-raising of clients on various topics: the use of digital solutions (27%), financial education (27%), health (11%) and environmental protection (11%). While these topics are less popular, they are related to the MFIs’ areas of development mentioned above and highlight the need to support clients so that they can adapt to these changes.

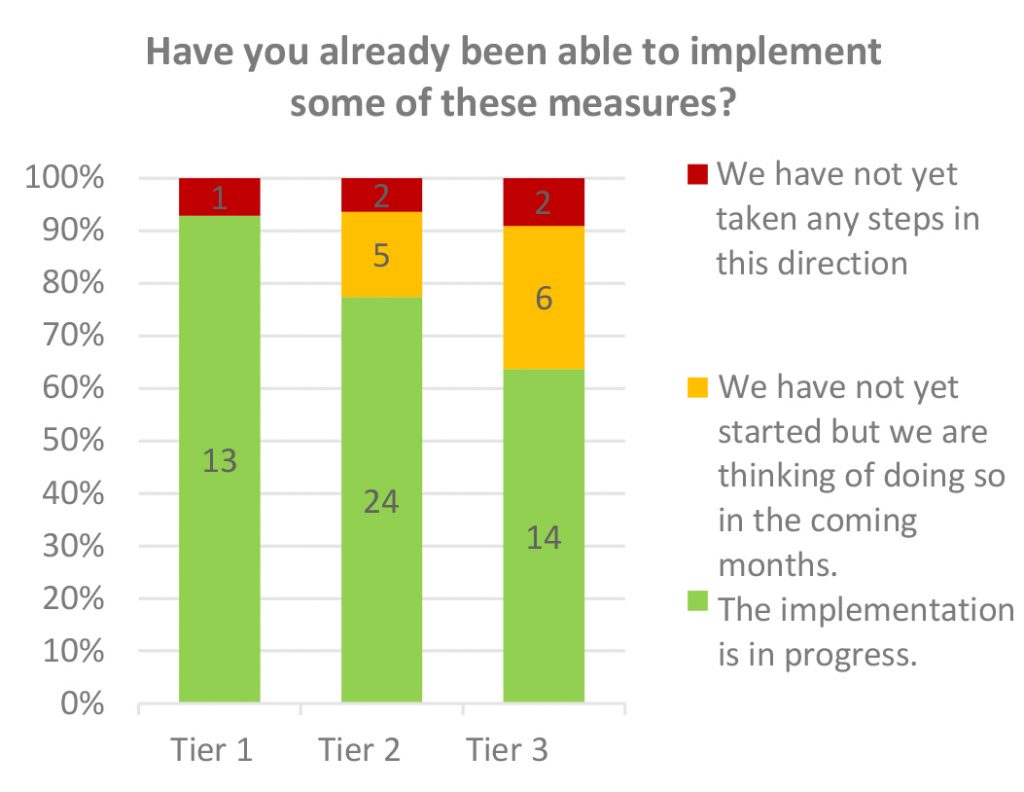

3. The capacity to implement these strategies varies according to the size of the MFIs

We note that 76% of the MFIs have already started to implement measures related to these strategic lines and 16% plan to launch actions in this direction in the coming months. Thus, only 7% of the sample have less clear perspectives on this point. A certain time lag in the implementation of these measures emerges however, depending on the size of the institutions: the vast majority of Tier 1 MFIs (93%) have already implemented such measures, whereas this proportion drops to 77% for Tier 2 and 64% for Tier 3 MFIs.

We note that 76% of the MFIs have already started to implement measures related to these strategic lines and 16% plan to launch actions in this direction in the coming months. Thus, only 7% of the sample have less clear perspectives on this point. A certain time lag in the implementation of these measures emerges however, depending on the size of the institutions: the vast majority of Tier 1 MFIs (93%) have already implemented such measures, whereas this proportion drops to 77% for Tier 2 and 64% for Tier 3 MFIs.

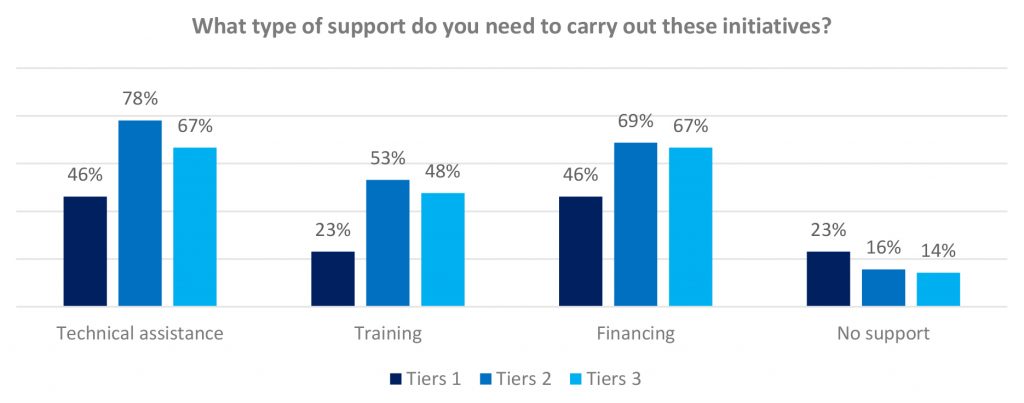

These differences by MFI size (which we already noted in our 2020 work on the direct consequences of the crisis on MFIs (4)) are also reflected in the level of support expected from external stakeholders (investors, donors, etc.). Whereas technical assistance (69% of responses) and dedicated funding (66%) are the two components that stand out the most for making progress on these issues, they are much more requested by Tiers 2 and 3 MFIs. Similarly, the ECA MFIs are the only ones to show a certain independence on this subject, with a third of the respondents in the zone not stressing any need for support.

The larger MFIs therefore appear to be better equipped and more autonomous after the crisis to meet their next challenges, as they were at the peak thereof. At the same time, some of the smaller MFIs also confirm strong orientations for the years to come, albeit to a lesser extent. They are no less ambitious even though they have fewer resources.

_____________________________________________

(1) The results of the first seven surveys are posted on //www.gca-foundation.org/observatoire-covid-19/, //www.ada-microfinance.org/fr/crise-du-covid-19/ and //www.inpulse.coop/news-and-media/

(2) Number of MFIs per region: ECA: 17 MFIs; SSA: 27 MFIs; LAC: 14 MFIs ; SSEA: 6 MFIs; MENA: 6 MFIs.

(3) Tier 3 MFIs have outstanding loans of less than US$5 million, Tier 2 MFIs between US$5 million and US$50 million, and Tier 1 MFIs over US$50 million.

(4) //www.gca-foundation.org/en/covid-19-affects-mfis-of-different-sizes-in-different-ways/

Signs of economic recovery remain mixed

ADA, Inpulse and the Grameen Crédit Agricole Foundation joined forces in 2020 to monitor and analyse the effects of the COVID-19 crisis on their partner microfinance institutions around the world. This monitoring was carried out periodically throughout 2020 to gain a better insight into how the crisis has developed internationally. We are extending this work this year, on a quarterly basis. The conclusions presented in this article follow the second quarter of 2021. With this regular analysis, we hope to contribute, at our level, to the construction of strategies and solutions adapted to the needs of our partners, as well as to the dissemination and exchange of information by and between the different stakeholders in the sector.

In summary

The results presented in the following pages come from the seventh survey in the series shared by[1] ADA, Inpulse and the Grameen Crédit Agricole Foundation. Responses from our partner microfinance institutions (MFIs) were collected in the second half of July 2021. The 78 institutions that responded are located in 40 countries in Sub-Saharan Africa (SSA-32%), Latin America and the Caribbean (LAC-30%), Eastern Europe and Central Asia (ECA-22%), North Africa and the Middle East (MENA-9%) and South and Southeast Asia (SSEA-6%).[2]

The fairly positive overall trend nevertheless conceals highly contrasting realities, with the largest number of institutions returning to growth and others continuing to encounter difficult economic conditions. The first group shows growth in their assets and positive development projections for the end of 2021. This outlook remains measured nonetheless (mostly between 0 and 10% of portfolio growth) as factors such as client demand and risk management continue to affect expansion opportunities.

Conversely, some institutions are facing difficulties specific to health contexts, the effects of which are weighing on economic life and are having a strong impact on transaction volumes. As a result, the profitability of their financial performance has been affected to the point of having a negative effect on the equity capital of the most fragile.

- An operating environment that continues to improve overall

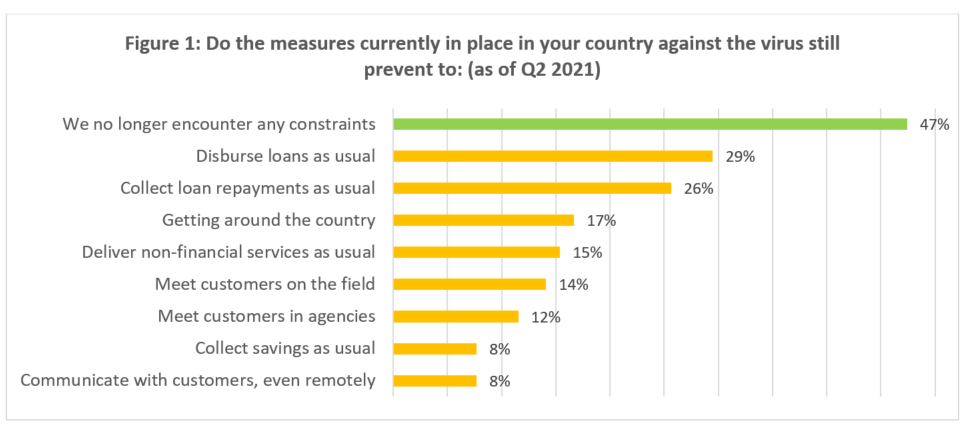

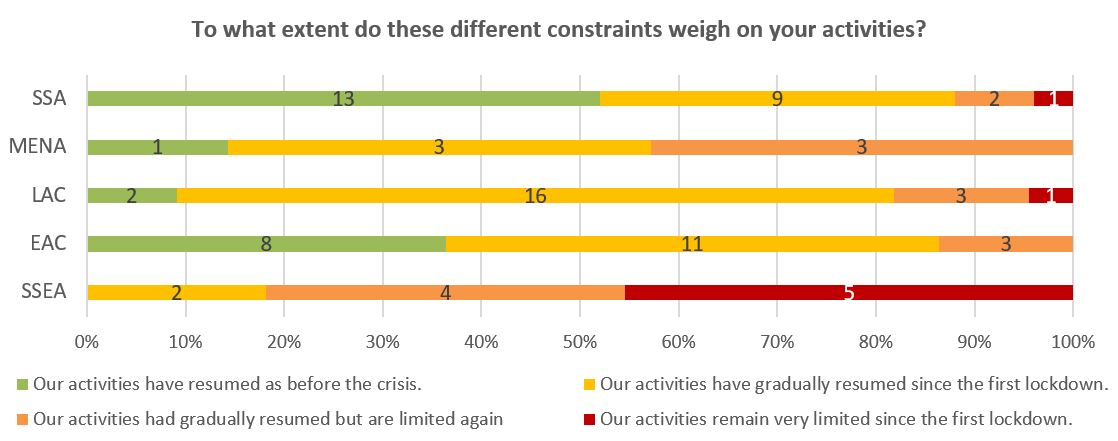

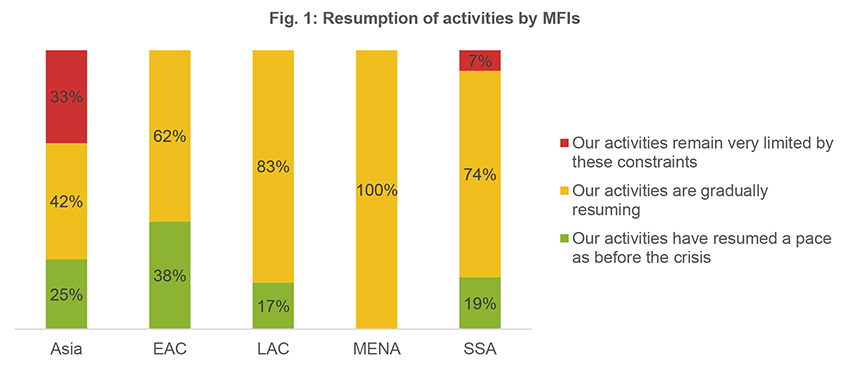

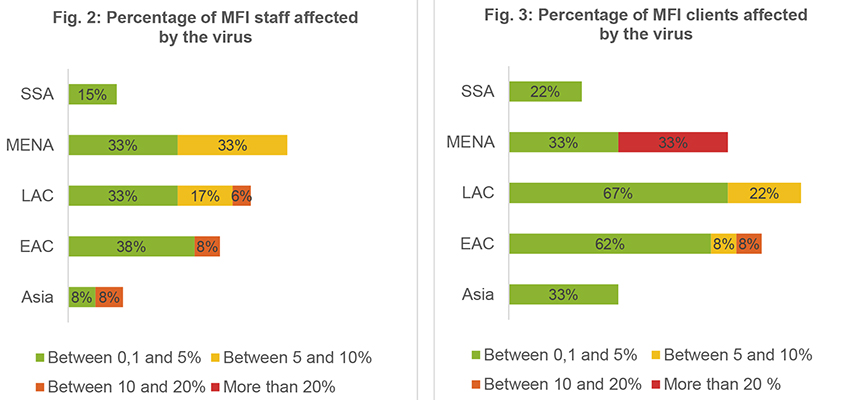

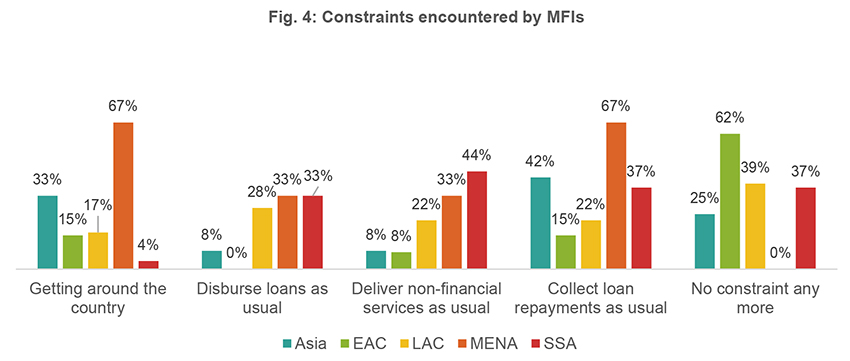

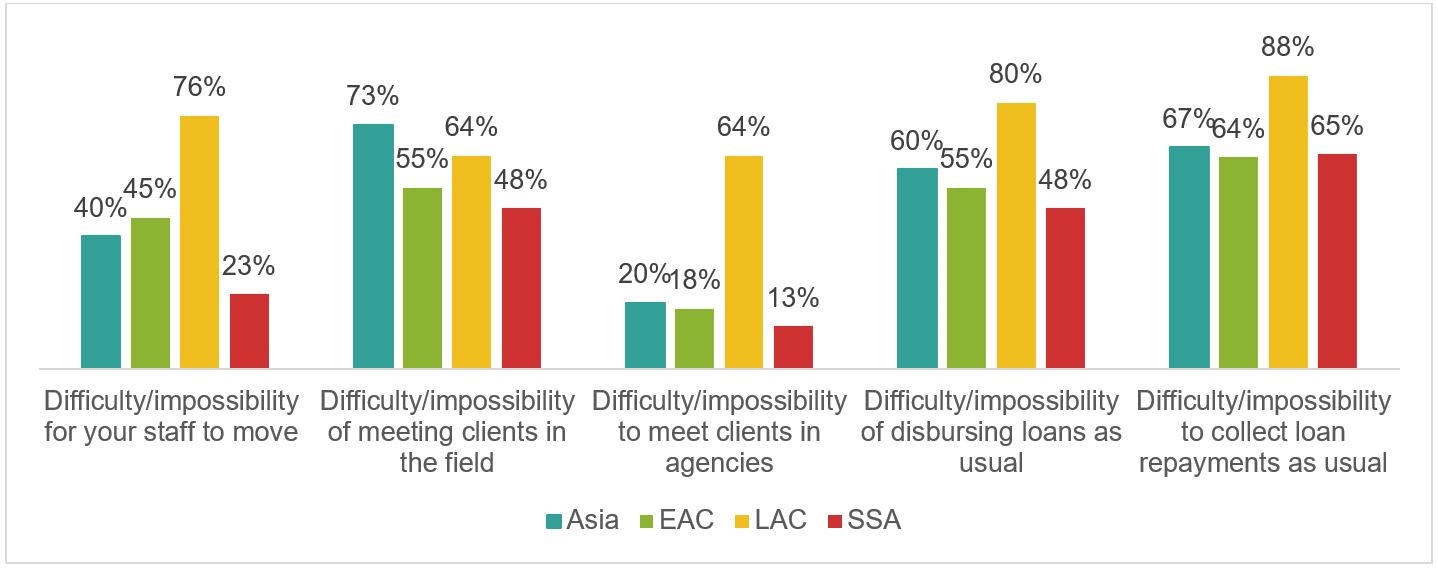

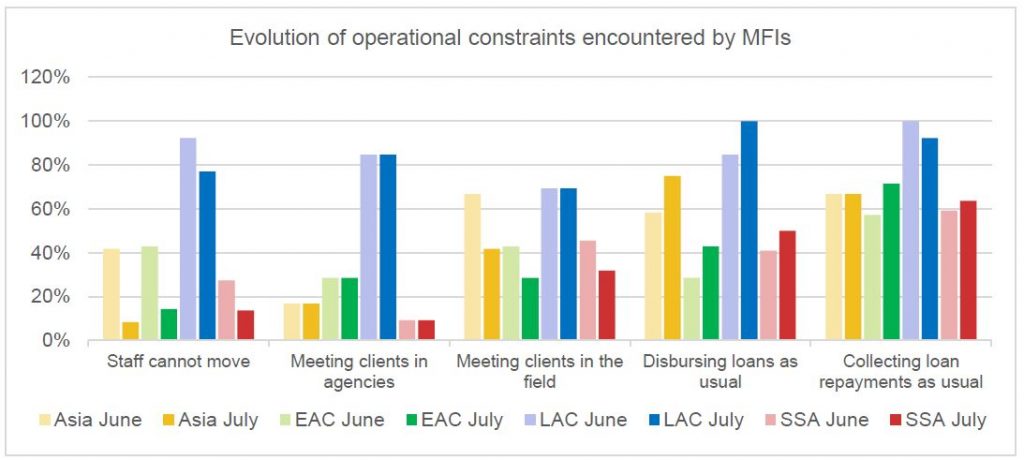

The reduction of operational constraints and the gradual recovery of business activities are again confirmed in this latest survey. Needless to say, this trend hides some disparities that are less well oriented due to the measures taken to fight the spread of the virus. At the beginning of July 2021, 47% of the institutions surveyed said that they no longer faced operational constraints on a daily basis (Figure 1). Also, all constraints relating to traveling in the country and meeting clients do not concern more than 20% of respondents.

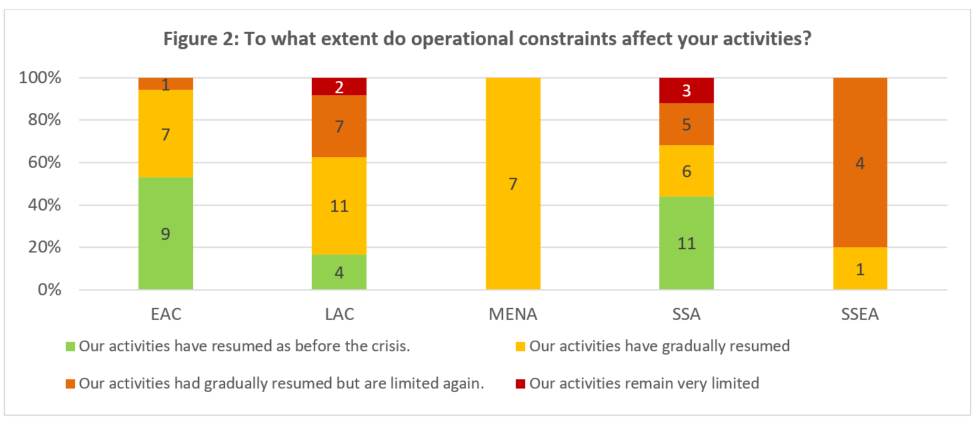

This is reflected in the level of activity of the institutions: 72% of the MFIs have either returned to a pace similar to that before the crisis or are experiencing a gradual recovery without major interruptions (figure 2). This phenomenon is particularly visible in the ECA region, where the level of activity has not declined for almost all institutions. In the LAC and SSA regions, a majority of organisations are in the same situation (63% and 68% respectively). In these areas, the difficulties are particularly acute in East Africa, Panama, and Honduras. Finally, for MFIs in the MENA region, the trend is towards recovery while those in SSEA are largely facing new difficulties (Cambodia, Laos, Myanmar, Sri Lanka).

- Part of MFIs have returned to growth

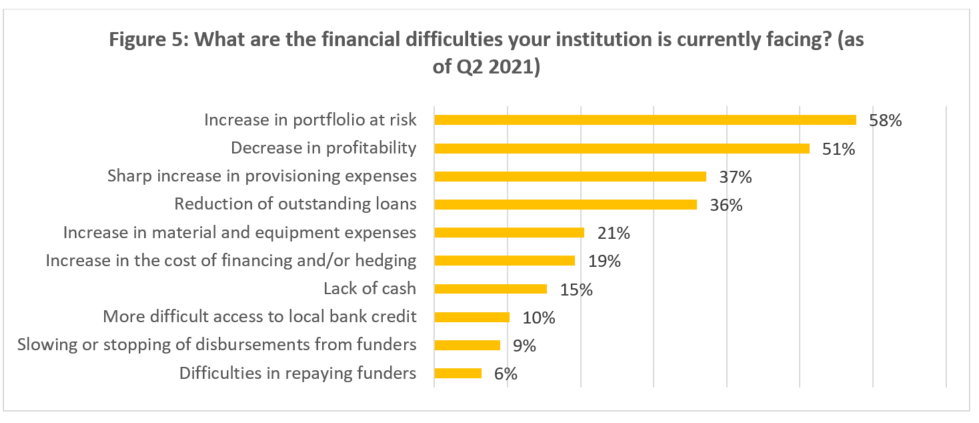

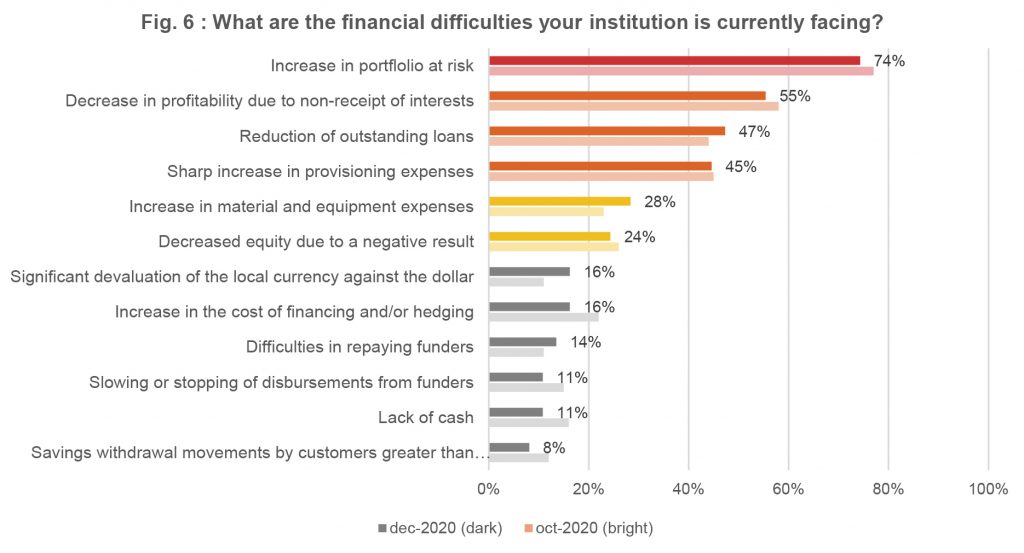

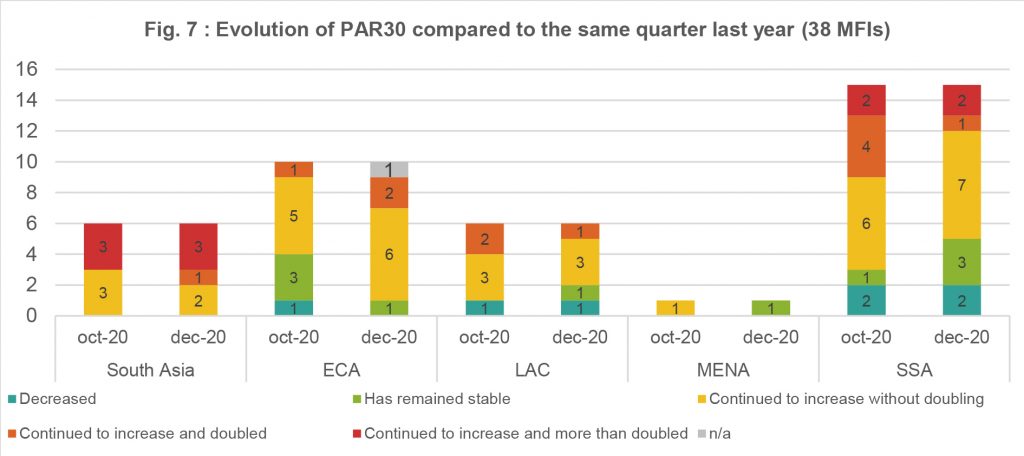

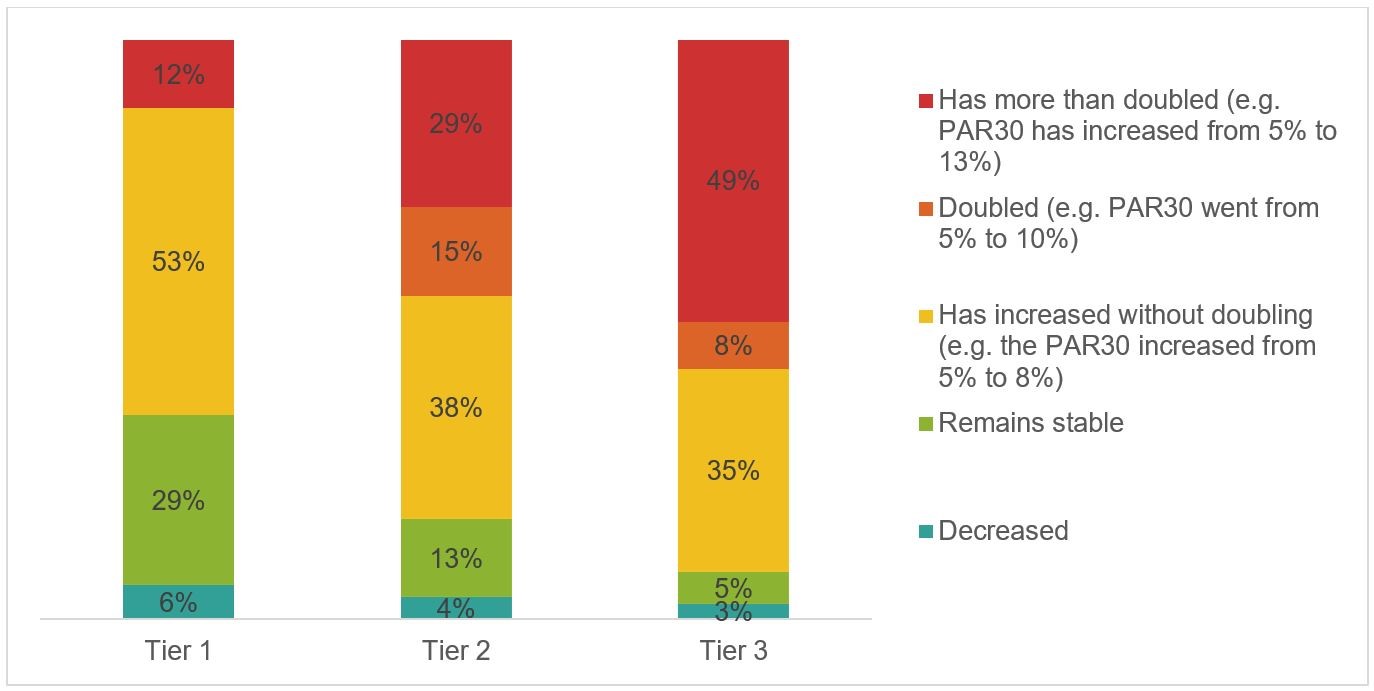

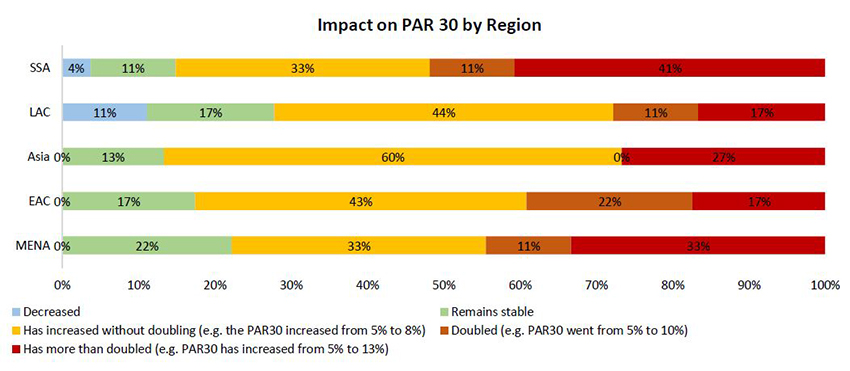

It is in this context that MFIs continue to disburse loans to their clients. Whereas the increase in portfolio at risk (PAR) and the reduction in the loan portfolio were the major financial consequences of the crisis in 2020, only 36% of the MFIs surveyed in July still report a decline in their outstanding loans (figure 5).

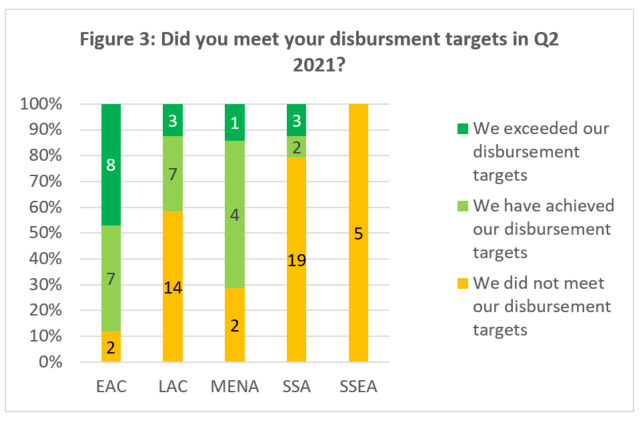

This positive analysis masks a slow process, however, as shown by the response of our partners to whether they met their disbursement targets in Q2 2021. More than half (53%) indicated that they did not meet their disbursement targets in this period, a figure that is relatively close to that obtained in Q1. This result is not entirely correlated with an organisation’s level of operations: more than half of the MFIs in the LAC and SSA regions report unmet targets despite a favourable operating environment. Note that three major reasons are cited by MFIs that did not meet their growth targets this quarter: the drop in amounts requested by clients (45%), clients’ reluctance to commit to new loans (43%), and managing risk by focusing only on existing clients (38%). Thus, MFIs in the EAC region are the exception with excellent performance in Q2 2021.

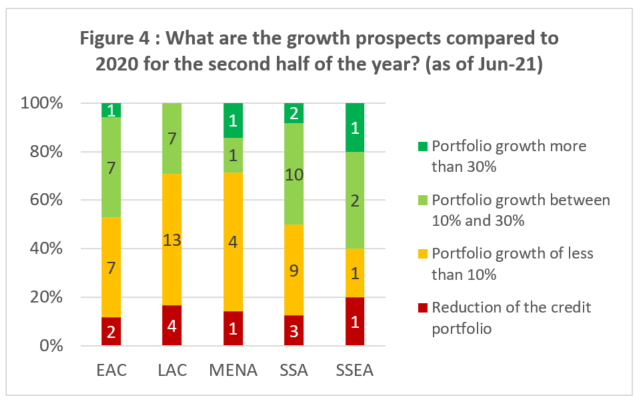

Even if these indicators reveal an inconsistent pace of development, the year 2021 is expected to end with growth in outstanding loans for the vast majority of MFIs. In fact, 86% of the institutions surveyed expect to have more outstanding loans than in December 2020 by the end of the year 2021. This growth will be reasonable for a large proportion of them: 44% of respondents expect portfolio growth of between 0 and 10%, particularly in the MENA and Latin America & Caribbean regions. For slightly more than a third of MFIs (36%), it will be between 10 and 30%. Projections are split between these two estimates in the other three regions analysed. Finally, it should be noted that 10-20% of MFIs in each region expect to reduce their outstanding loans.

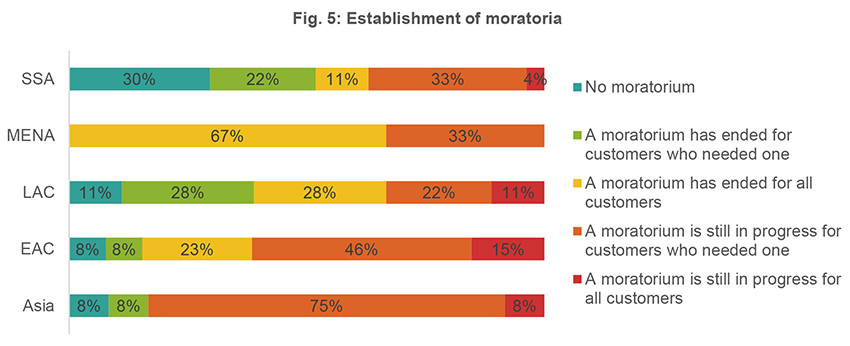

- Credit risk remains under control but is still present

Despite these reassuring signs of portfolio growth, MFIs still face a high credit risk, a lingering remnant of the crisis. In point of fact, 58% of respondents in Q2 2021 stated that the current portfolio at risk remains higher than in early 2020. While some institutions still have an active moratorium (only 5%), the loans of clients in trouble at the beginning of the crisis are now showing up in the PAR as restructured or delinquent loans. In addition, there are clients in arrears who did not have a moratorium. All these loans are provisioned to cover the proven risk of default. The decline in profitability is another major financial consequence of the crisis, fuelled by the sharp increase in provisioning expenses and the reduction in the number of outstanding loans.

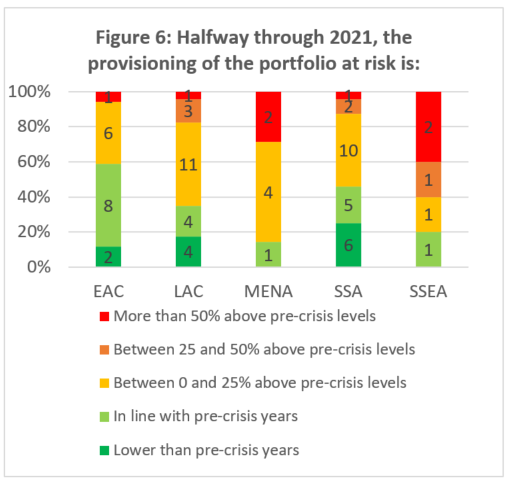

In detail, it appears that 59% of our partners have increased their provisioning levels compared with before the crisis (Figure 6). For most (71% of these 59%), the increase is between 0 and 25% of the usual amount, a situation that is found in every region except the SSEA. Conversely, there is a group of MFIs (40%) that no longer see a major increase in credit risk and whose provisioning expenses are similar to the past or even decreasing. In this respect, the ECA region again stands out, as this is the case for nearly 60% of the organisations surveyed in the region.

As we noted in our recent studies, however, this has not yet translated into a very large increase in loan write-offs. At the end of Q2 2021, 59% of respondents indicated that loan write-off levels for the year were either down from previous years or at the same level. Nevertheless, 13% of MFIs had to write off at least twice as many loans as they did before the crisis.

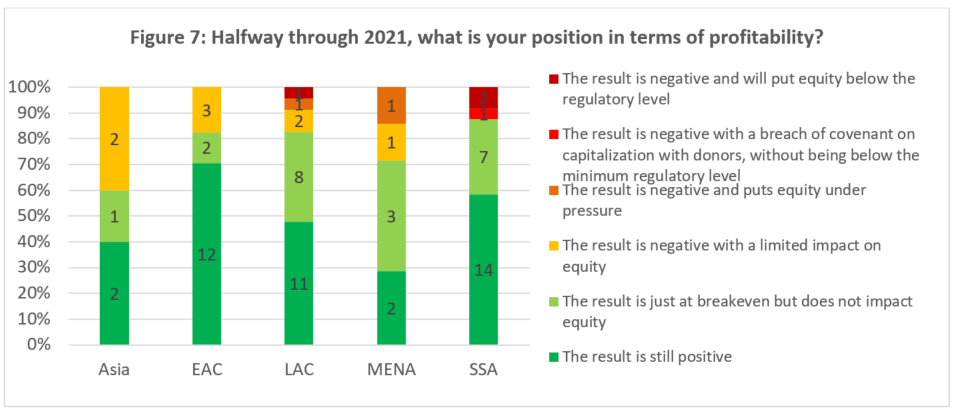

- Equity has been largely unaffected so far

The profitability of microfinance institutions is affected by the return of business activities, the variation in outstanding loans and the risk coverage (factors presented in the foregoing paragraphs). The trend is downward for 51% of our partners (Figure 5). However, the information collected at the end of June 2021 is reassuring: 80% of respondents have a level of profitability that is at least balanced, which does not affect the capital of their structure (Figure 7). In the same vein, despite a negative result, 11% of respondents do not feel pressure on their equity. The situation is nonetheless more critical for 8% of the partners surveyed, whose level of capitalisation is at risk, leading to a potential breach of covenant with their funders or the regulator.

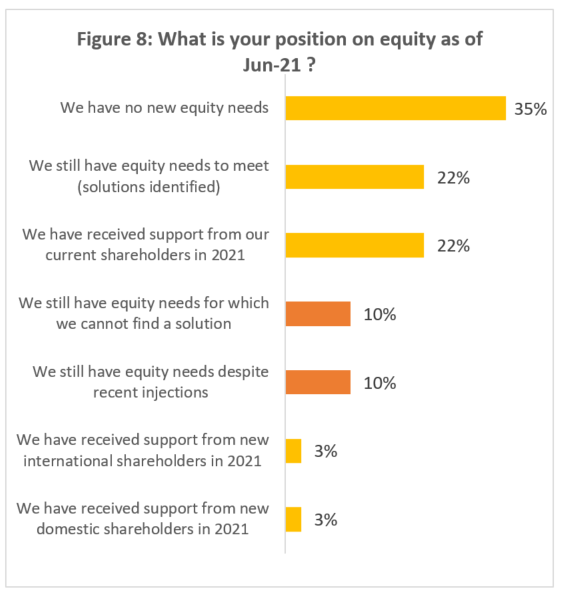

Given the difficulties faced by some of the clients, whom are up against new waves of complications related to COVID-19 or other factors, potential losses could affect the solvency of microfinance institutions. Some of them already require the intervention of their shareholders or investors. In our last study, we learned that the type of shareholder that institutions want to turn to depends on the reason why this support is needed (to cover losses or to grow). This survey shows that 20% of the respondents are already confronted by this issue: needs may arise despite recent capital support, but some MFIs are also without a solution in this regard (10%). These cases show that the impact of the crisis will still be felt by institutions already hard hit by this unprecedented period, but also by less robust MFIs. Vigilance on capital need remains necessary as the long-term impact of credit risk could turn the tables on other organisations if the overall situation does not improve, for example with the arrival of new epidemic waves.

[1] The results of the first five surveys are available here : //www.gca-foundation.org/en/covid-19-observatory/, //www.ada-microfinance.org/en/covid-19-crisis/ and //www.inpulse.coop/news-and-media/

[2] Number of responding MFIs per region: ECA 17 MFIs; SSA 25 MFIs; LAC 24 MFIs; SSEA 5 MFIs; MENA: 7 MFIs.

The Foundation publishes its report “The impact of the crisis on microfinance institutions”

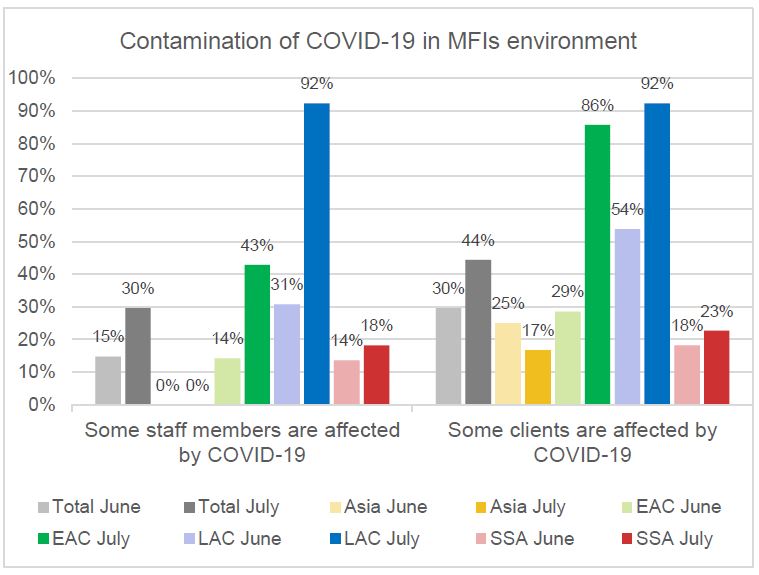

The Covid-19 pandemic affected all economies impacting fragile economies and the most vulnerable populations in particular.

The Grameen Crédit Agricole Foundation began to investigate the unprecedented effects of this global crisis on microfinance institutions (MFIs). An initial survey was launched in March 2020 to understand how our MFI partners were adapting to the repercussions of the pandemic that had already had an impact on their activities.

In the following months, the Foundation collaborated with two other major players in inclusive finance, ADA and Inpulse, to extend the scope of this study to more than 100 MFIs in 4 continents: Africa, South America, Asia and Europe. Overall, 6 surveys were conducted since the inaugural questionnaire in March.

You will discover through this report the results of these studies divided into three main parts:

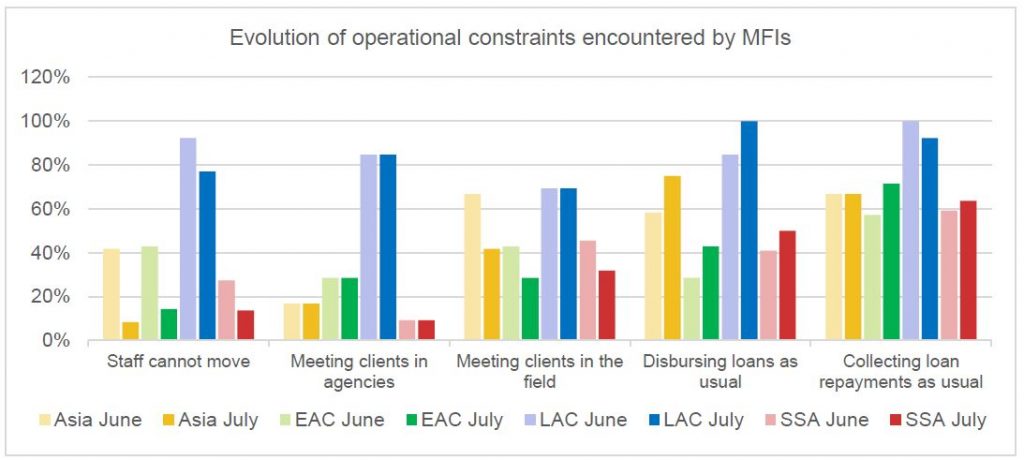

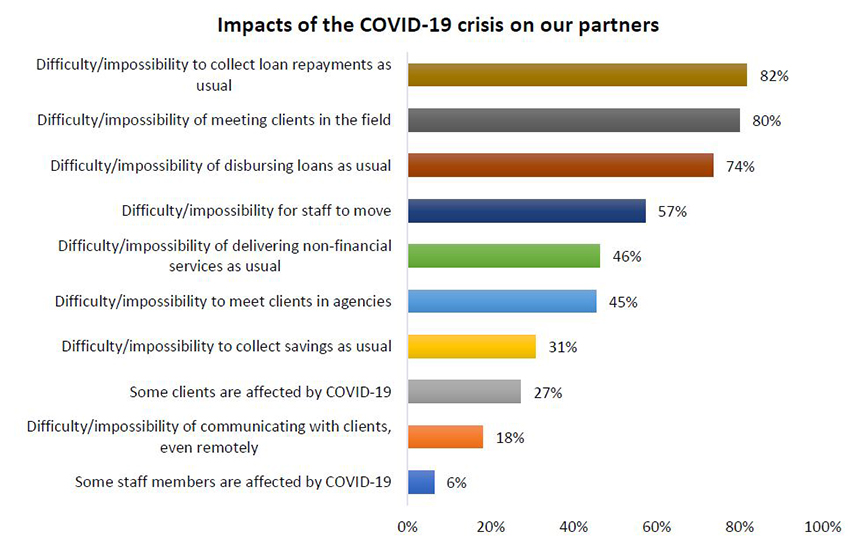

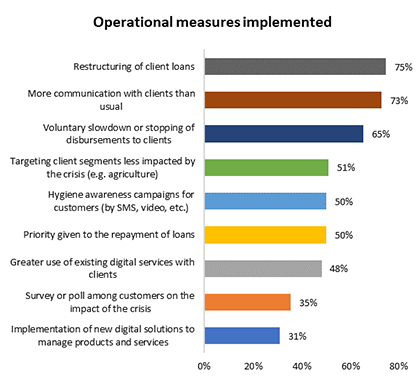

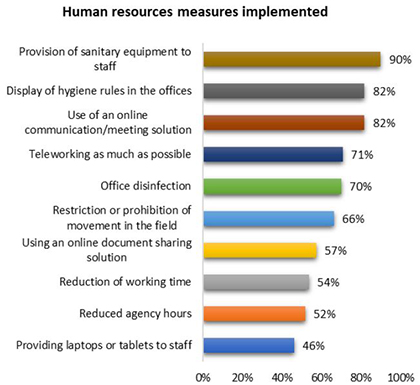

Adapting rapidly to operational constraints

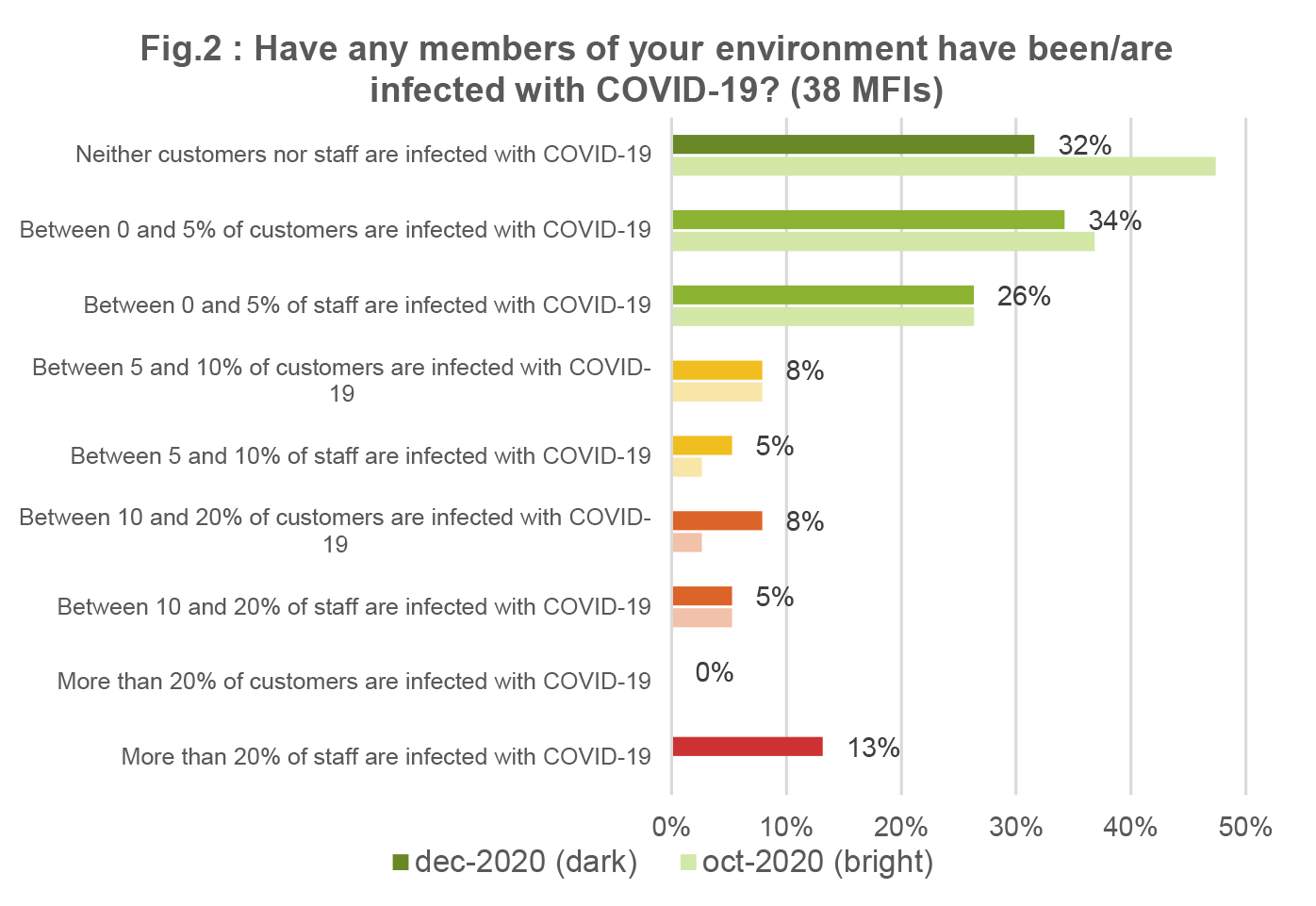

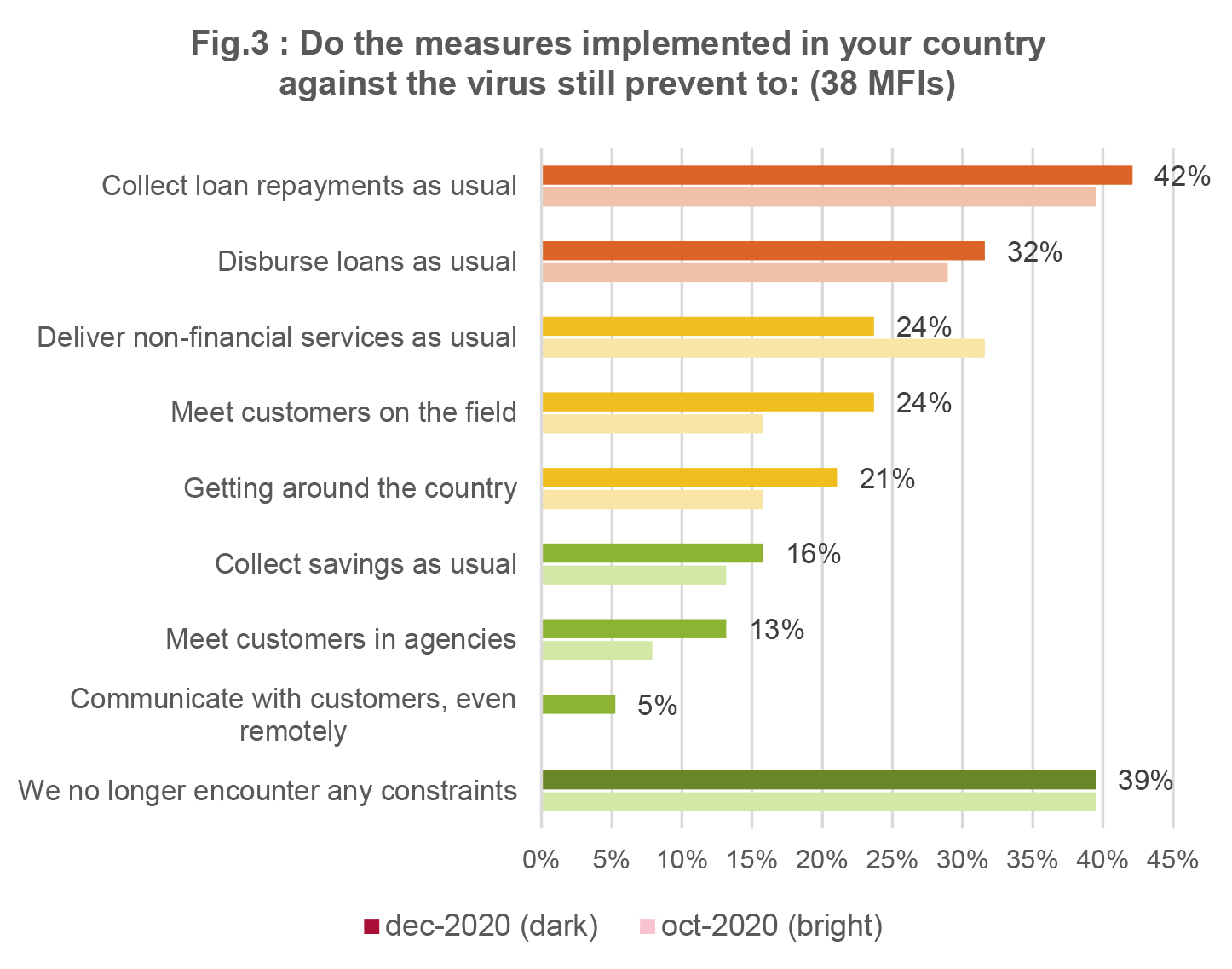

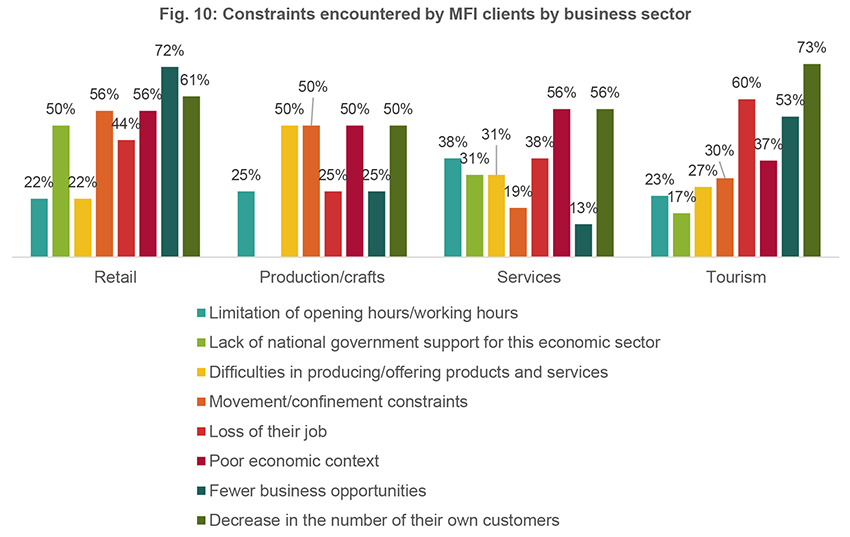

Surveys conducted throughout 2020 revealed three major difficulties: the impossibility of meeting clients in person, difficulties in collecting repayments and complications in disbursing loans.

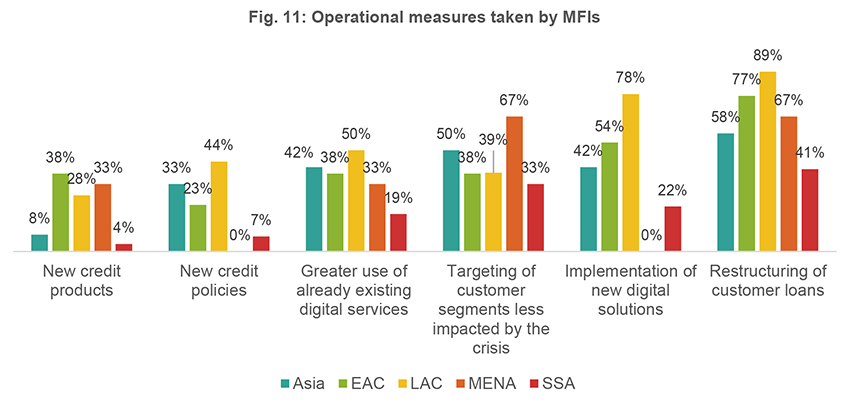

In an effort to address these difficulties, MFIs acted in a proactive and appropriate manner, showing the great resilience capacity of those organisations. However, all FMIs haven’t been impacted in the same way. This document describes those constraints and the measures that have been implemented.

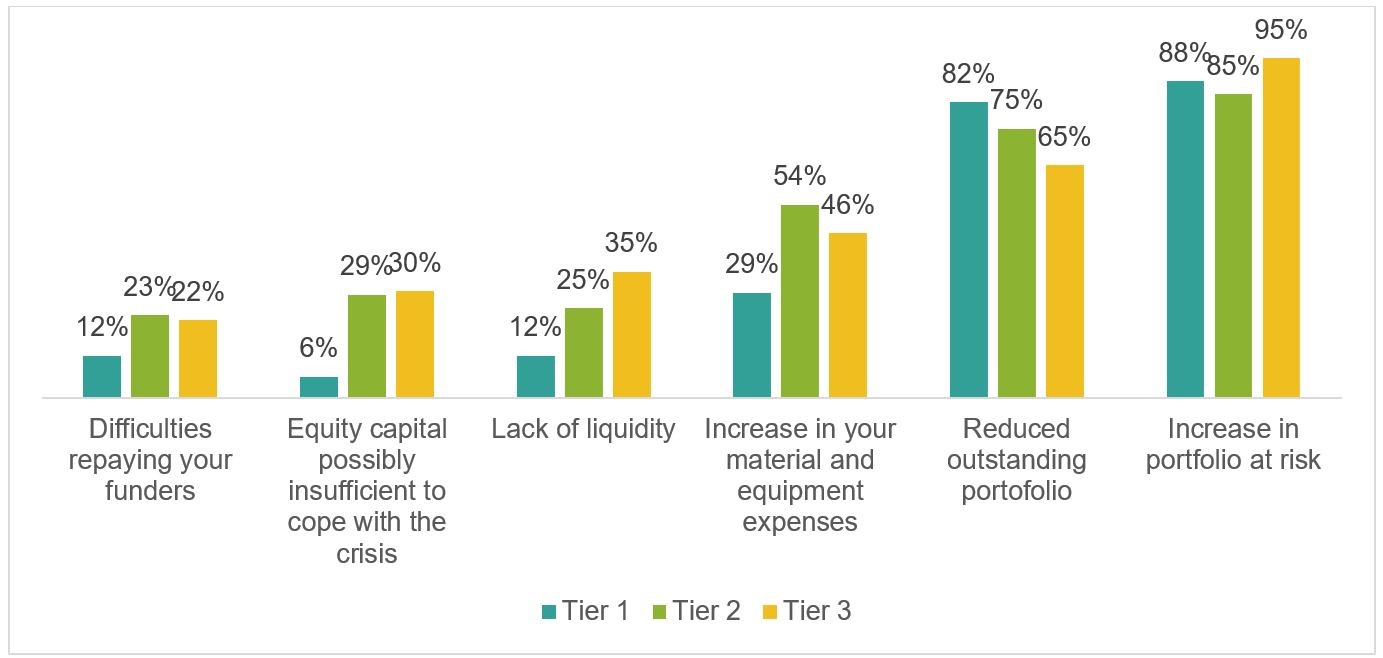

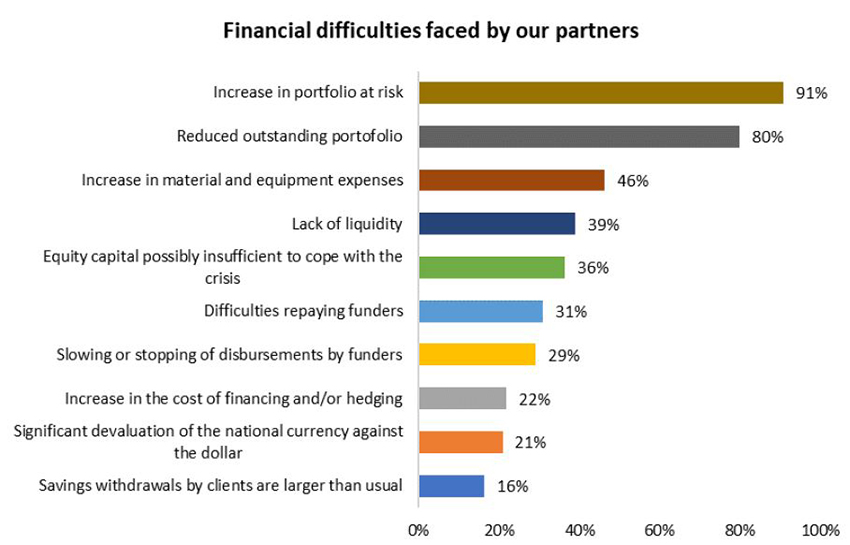

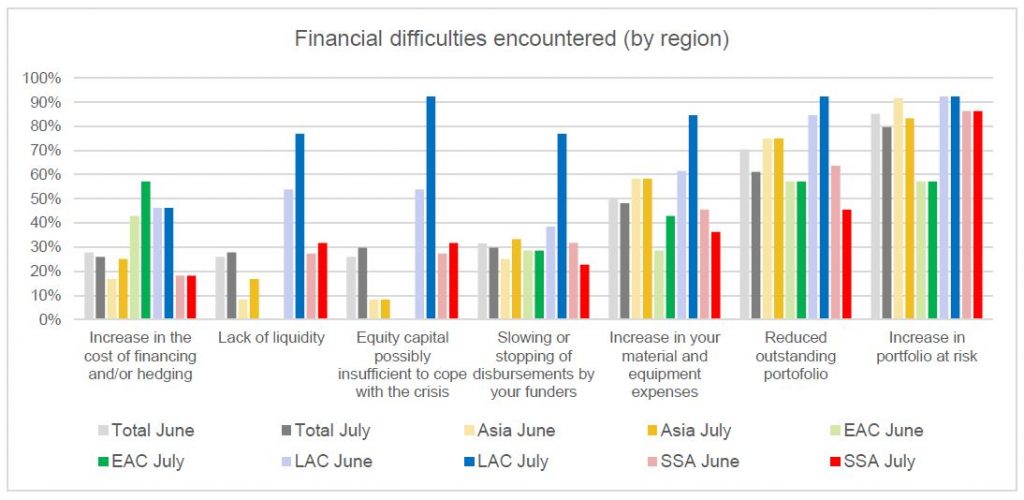

A significant and sustained financial impact

The operational constraints encountered have inevitably had significant financial repercussions. We observe two major consequences for almost all MFIs: an increase in the portfolio at risk (PAR) due to lower repayments, and a reduction in outstanding loans due to lower disbursements.

Those two consequences fluctuated throughout the year depending on local contexts and other financial difficulties may have arisen in some cases. The analysis of performance indicators, detailed in this document, enables us to see the lasting effect of the crisis.

Prospects for the future

In the face of the crisis, most MFIs have shown resilience. Among the levers envisaged to return to financial stability: increasing the volume of their portfolio and the number of clients, and opening up to new products and services, and even to new markets, in 2021.

You will discover throughout the report other measures MFIs explored to adapt to the crisis, which are reassuring for the future of the sector.

Despite the often positive indicators, we remain vigilant in the face of the current volatile environment. For this reason, we have maintained our approach of regular surveys in 2021, on a quarterly basis.

The Covid-19 crisis and gender inequalities

Miren Bengoa, Director, member of Financial, Risks and Impact Committee,

Grameen Crédit Agricole Foundation & International Action Director, SOS Group

Director of the Grameen Crédit Agricole Foundation since 2020, Miren Bengoa has been, since January 2021, the new International Action Director of the SOS Group. Since 2011, she was at the head of Fondation CHANEL, which supports projects improving the economic and social situation of women. She shares her view on the impact of the Covid-19 crisis on gender equality and the responses to address it.

— What is the impact of Covid-19 on the status of women?

MB: One of the immediate consequences of the Covid-19 crisis is the rise in inequalities between women and men. We have seen during this pandemic an increase in violence against women and girls and a decline in girls’ learning as dropout rates and child marriage increase. Tens of millions more women have fallen into extreme poverty as they lose their jobs at a faster rate than men. Moreover, they suffer from difficulties in accessing new technologies and lack of digital skills.

— In a few words, what is the panorama of gender inequality in the world today?

MB: Current projections indicate that gender equality will not be achieved for another 130 years. In 2020, women represented on average (on a global scale) 4.4% of business leaders, 16.9% of Board members, 25% of parliamentarians and 13% of peace negotiators. Only 22 countries are currently headed by a female head of State or government (UN Women, 2020). We need better representation of women that reflects the diversity and abilities of women and girls.

— How can female entrepreneurship be an answer to the crisis?

MB: Women entrepreneurs have been at the forefront and strongly affected by the decline in economic activity. They are nonetheless also the bearers of innovative solutions and should be supported as much as possible by funders and public authorities. Being strongly involved in responding to community needs, they have been able to adapt their activities to the constraints of the pandemic. This has not been easy: they have sometimes been the first to give up a income generating activity so as to give priority to their families.

— Promoting women empowerment is one of the missions of the Grameen Crédit Agricole Foundation. What should be the priorities to boost this aspiration?

MB: Since its creation, promoting women empowerment has been at the heart of the Foundation’s action: among the 7 million clients of microfinance institutions supported, 73% are women beneficiaries of microcredits to create or develop income-generating activities. Maintaining funding, flexibility in rollovers and frequent analysis of the needs of these institutions are and will be key to enable them to regain a capacity for action in favour of female entrepreneurship.

COVID-19 : The Foundation’s governance during the health crisis

Spotlight on the interview with Sylvie Lemmet, Chairman of the Finance, Risks and Impact Committee, Jérôme Brunel, Chairman of the Compliance and Internal Control Committee, and Bernard Lepot, Chairman of the Investment Committee.

Looking back on the outbreak of the crisis, could you tell us how you perceived it at the time?

Bernard Lepot: We all understood as early as March that we were in unknown territory for an indefinite period of time, with systemic consequences that were difficult to grasp. All continents were affected, including Africa and Asia, where we have most of our activities. The risk of serious difficulties for our partners was likely, with possible large provisions for the Foundation. Despite this lack of visibility, the Board had to define the Foundation’s position quickly, which we summarise as follows: support for our existing partners and consultation with other international lenders.

Sylvie Lemmet: Last March, we were completely in the dark. We felt that the crisis was going to hit developing countries hard and that we were going to face potential bankruptcies and losses for the Foundation. We were worried for our partners.

Jérôme Brunel: I feared that the impact of the pandemic, which I thought would affect developing or less developed emerging countries more strongly (though this has not been confirmed) would weaken the solidity of the Foundation’s counterparties, leading to a substantial amount of provisions. This has not materialised up to now thanks to the resilience of the organisations supported and the coordination and joint actions of the various stakeholders in the inclusive finance sector.

What has been the role of the Committee you chair in this context?

JB: The Compliance and Internal Control Committee has played its role by adapting the internal control system to the increase in Covid-19 risks, organising training on debt restructuring methods, adapting the provisioning policy and collecting more information on the end clients of our counterparties. But to be honest, it was the Finance, Risks and Impact Committee that had the primary role in mobilising the Foundation’s governance to deal with the consequences of the pandemic.

SL: The Finance, Risks and Impact (FRI) Committee already includes the Chair of the Compliance and Internal Control Committee among its members. Last year, we immediately felt the need to make the link with the Investment Committee, and its Chair also sat on the FRI Committee. The development of governance with this ad hoc committee has been extremely positive. It enabled us to build together, and with the Foundation’s Management Committee, a good understanding of the overall situation (the impact on the portfolio, liquidity and margin) and an intervention doctrine, which we developed as the crisis progressed. The objective is to provide the necessary oxygen to our partners while monitoring the risk of default.

BL: Once the roadmap was established, the Investment Committee continued to meet every month, but by videoconferencing, with a reduced number of new projects of course, but with close monitoring of the maturity extensions granted to microfinance institutions that requested them and, more generally, enhanced risk monitoring. The Board also decided to set up an ad hoc committee consisting of the three chairmen of the specialized committees to examine and discuss possible adjustments to the Foundation’s strategy. This body met several times to exchange views with the teams and to provide input to the Board before decisions were made.

What lessons have you learned from this experience one year later, and what prospects do you see for the Foundation in 2021?

SL: One year on, I am above all reassured by the quality of the men and women who make up the Foundation’s executive team and who have been able to respond to an unprecedented situation with great flexibility, professionalism and commitment. We were able to control the financial risks without abandoning our partners in difficulty, and to test the resilience of the organisations we supported, which reassures us as to their quality and as well as the resistance of the microfinance sector to shocks. This is a point that needs to be explored in order to gain a better understanding of the mechanisms that have been implemented locally and the real social impact behind the good financial performance. We all hope for a return to a less chaotic situation and the resumption of activities in 2021. We will have to learn the lessons of remote instructions and juggle with an activity that seems to be picking up though travel remains limited. The pandemic is not yet behind us, but I hope it will remain under control in the countries in which we operate.

JB: The health crisis has shown, first, the solidity of the commitments undertaken by the Foundation, i.e. the judicious choice of its counterparts. Secondly, the quality of the response of the team and its Managing Director to adapt to this unprecedented context, helped by the mobilisation of its Board and its specialised committees. Finally, the Foundation’s commitment to continue its lending activity despite this «hostile» environment and to support microfinance institutions through an international initiative to harmonise the policies of other lenders and a precise dialogue with each of the borrowers.

BL: One year on, it is worth underscoring the remarkable mobilisation and adaptation of the Foundation’s teams, with great collaboration between the various functions. We should also note the great resilience of our portfolio to date, which has perhaps exceeded our expectations. Good information/involvement on the part of the Board has enabled it to express its full support and solidarity with the Foundation’s strategy and actions. Things are still very uncertain for 2021, with perhaps a better visibility in the 4th quarter, but again nothing is certain. Let’s hope that 2021 will be a year of transition that will enable us to resume our development activities in 2022.

Download the 2020 Integrated Report here.

In 2020, the Foundation strengthened its technical assistance activity

By Violette Cubier, TA Manager, Grameen Crédit Agricole Foundation

We continued to develop our third business line in 2020, namely technical assistance for our partners. Our technical assistance missions have contributed to the institutional strengthening and resilience of our partners in this time of crisis.

The Foundation supports its partners through various technical assistance programmes. This support covers a variety of issues such as operations and human resources management, governance, financial management, strategic planning, digitalisation of operations and products, launch of new services, risk management and social and environmental performance management.

The Foundation mobilised to provide close support to its partners throughout 2020. The technical assistance missions were adapted to respond to the priorities and emergencies that the partners had to face (liquidity management and portfolio quality, business continuity plans), but also to support them in their business recovery, their strategic reflections and the transitions necessary to face the crisis (digitalisation, strengthening of activities in rural areas). We also set up joint actions with other actors such as SIDI and the Fefisol fund, with whom we have organised training for some fifty organisations in Africa.

The year 2020 was also marked by a strong development of our technical assistance activities, with an increase in existing programmes and the launch of new programmes. The latter enabled the Foundation to extend the geographical areas of operation in technical assistance and to address more actively key issues such as the development of rural economies, adaptation to climate change or the financial inclusion of refugees.

The coordination of technical assistance activities is now a major focus of the Foundation’s operation for contributing to the institutional strengthening of its partners and supporting them in their economic, ecological and digital transitions, thereby increasing their impact on the ground.

More information: //www.gca-foundation.org/en/technical-assistance

Download the 2020 Integrated Report here

Persistent credit risk : a threat to the solvency of microfinance institutions ?

ADA, Inpulse and the Grameen Crédit Agricole Foundation joined forces in 2020 to monitor and analyse the effects of the COVID-19 crisis on their partner microfinance institutions around the world. This monitoring was carried out periodically throughout 2020 in order to gain a better vision of the development of the crisis at the international level. We are extending this work this year on a quarterly basis. The conclusions set out in this article follow the first quarter of 2021. With this regular analysis, we hope to contribute, at our level, to the charting of strategies and solutions adapted to the needs of our partners, as well as to the dissemination and exchange of information by and between the different stakeholders in the sector.

In a nutshell

The results presented in the following pages come from the sixth survey (1) of the joint ADA, Inpulse and Grameen Crédit Agricole Foundation series. The responses from our partner microfinance institutions were collected in the second half of April 2021. The 87 institutions that responded are located in 47 countries in Eastern Europe and Central Asia (EECA-25%), Sub-Saharan Africa (SSA-29%), Latin America and the Caribbean (LAC-25%), South and Southeast Asia (SSEA-13%) and the Middle East and North Africa (MENA-8%) (2).

Whereas the general improvement in the local contexts relating to COVID-19 enables microfinance institutions to conduct their activities better, our latest survey shows that MFIs nevertheless had a lot of difficulties in reaching their development goals in the first quarter of 2021. The reasons cited have mainly to do with the difficulties encountered by the customers of the MFIs. Such customers are reluctant to commit to new loans, and if they do, it is for smaller amounts than in the past. At the same time, their risk profile has deteriorated due to the crisis and the MFIs will find it more difficult to finance them.

This general trend of increasing risk has led to a decline in the quality of the portfolio of the MFIs. In 2020, it has ultimately been reflected in the profit and loss accounts of institutions with an increase in provisioning expenses. This is likely to be the case again this year, with additional reserves but also loan write-offs.

In fact, the operations of the MFIs have been reduced or slowed down, generally with a decrease in the level of their equity capital. In point of fact, one in two MFIs, irrespective of size, indicates a need for capital in 2021. Two trends emerge: the MFIs are counting on their current shareholders to cover the losses linked to the crisis. Conversely, international investors are expected to support their development as of this year. The answers provided by our partners therefore underscore the need for recapitalization this year, which will involve all the players in the sector.

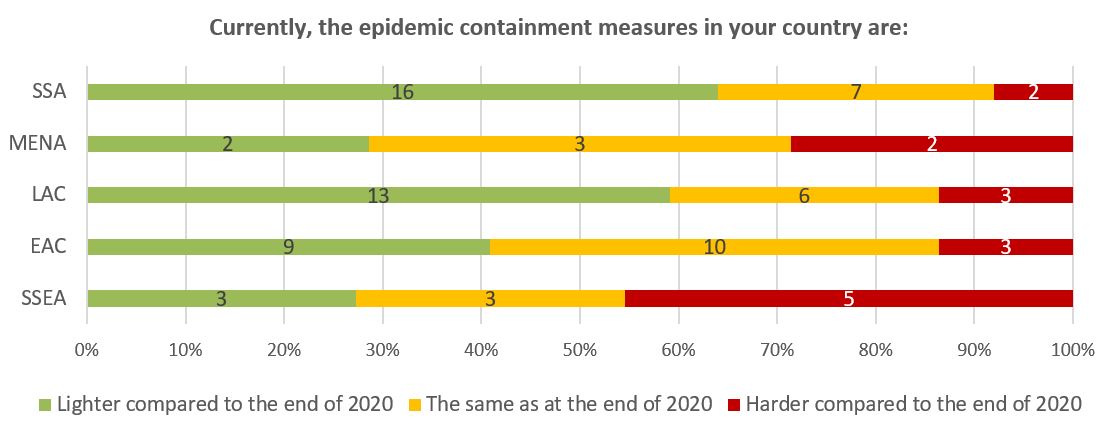

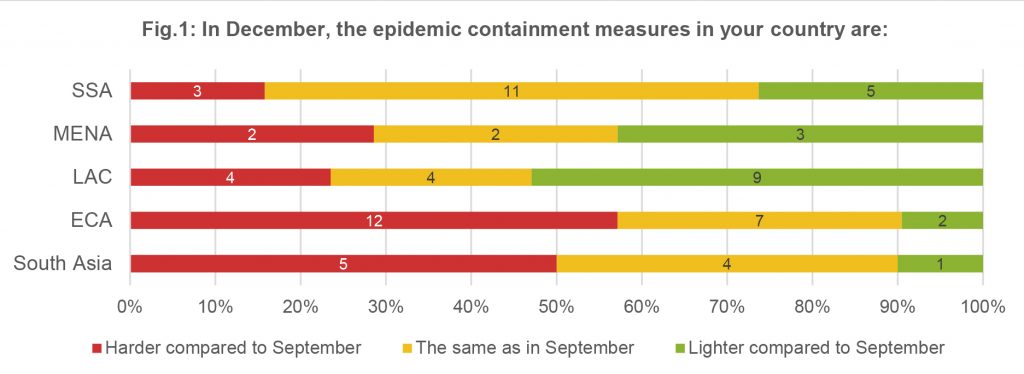

1. Disbursement levels are still low notwithstanding the reduction in constraints

Whereas we have seen a gradual but definite reduction in operational constraints for MFIs since the summer of 2020, this phenomenon continues in the first quarter of 2021. 50% of MFIs in all indicate that the measures in place in their countries are less constraining in April compared to the end of 2020. This is particularly pronounced in Sub-Saharan Africa (64% of respondents in the region) and Latin America and the Caribbean (59%). This is to a lesser extent true for MFIs in Europe and Central Asia, where the situation is either improving or stable. Finally, the situation is opposite in South and South-East Asia, with 45% of respondents in the region reporting a more difficult context, with the Cambodian and Burmese situations weighing on results.

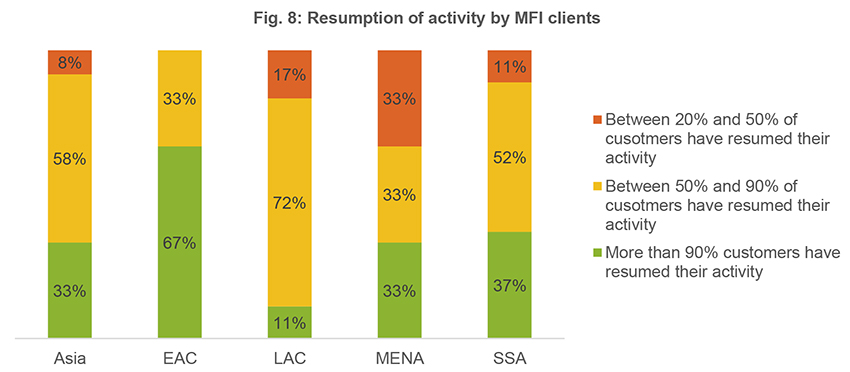

Almost half of the respondents overall report that they no longer face any operational constraints in conducting their activities. This is reflected in the resumption of activity by the MFIs: 52% of those in sub-Saharan Africa can work as before the crisis. The vast majority of MFIs in Latin America are gradually resuming their activities since the first difficulties encountered. The situation in Europe and Central Asia is again divided between gradual or almost complete recovery. Conversely, the deteriorated context for MFIs in the SSEA region is reflected in activities that are either still constrained or are again affected by new measures to contain the epidemic.

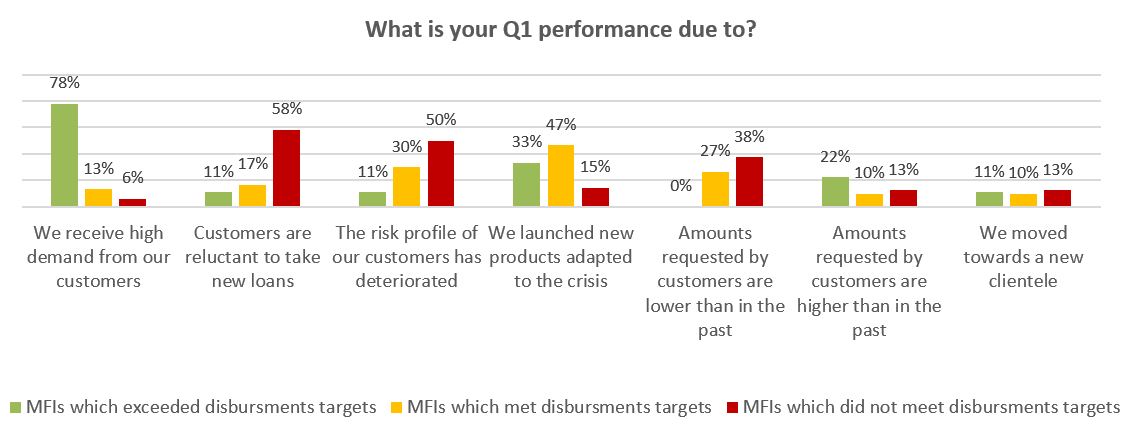

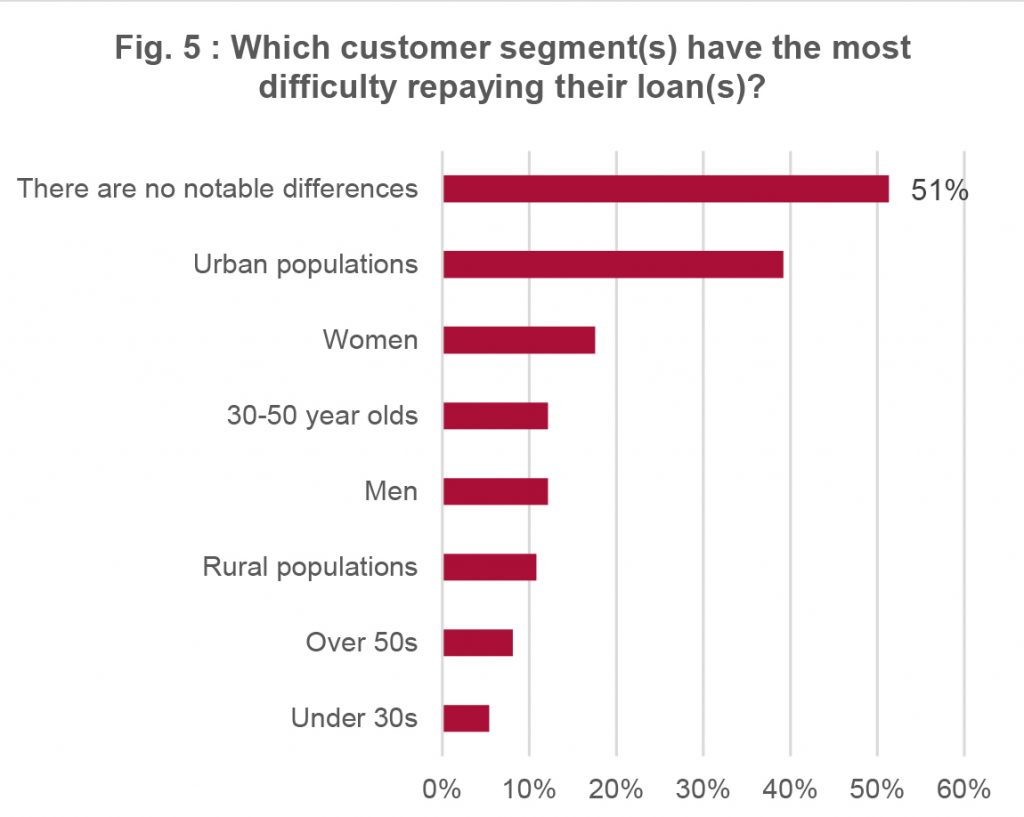

Despite these continued positive signals on the level of activity of our partners, the expected level of loan disbursement for the quarter is apparently still difficult to achieve. For example, 55% of respondents report that they did not meet their loan disbursement targets in the first quarter of 2021. Only 10% of respondents exceeded their expectations, while 35% managed to meet their targets. The responses do not appear to pertain solely to business recovery: for example, 80% of MFIs in Sub-Saharan Africa did not meet their disbursement targets in the first quarter, while half report a return to near pre-crisis levels of activity.

When the MFIs did not meet their growth targets at the beginning of the year, three reasons stand out to explain this phenomenon. Firstly, the fact that customers are still reluctant to take out new loans (58% of this group), especially in a still rather uncertain context. Secondly, this is explained by the deteriorating risk profile of customers (50%), who are no longer eligible for loans or are eligible for smaller amounts (38%).

The latter two arguments are also mentioned by MFIs that have reached their targets without exceeding them. Nevertheless, this dynamic is partly offset by the fact that institutions have adjusted to the crisis and have put in place products adapted (digital, targeted sectors, etc.) to the current contexts in order to meet demand (47%).

Finally, the trend is quite different for MFIs that have exceeded their disbursement targets: the main factor is the strong demand received (78%), while the adjustment of the offer (33%) and the increase in the amounts requested (22%) support this trend.

2. A persistent high credit risk continues to have a significant impact on institutions’ profitability

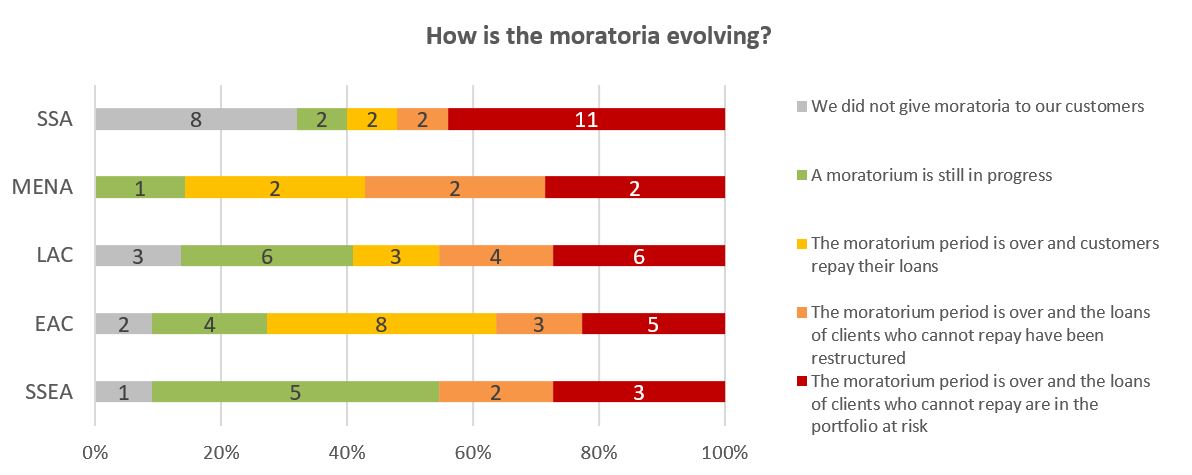

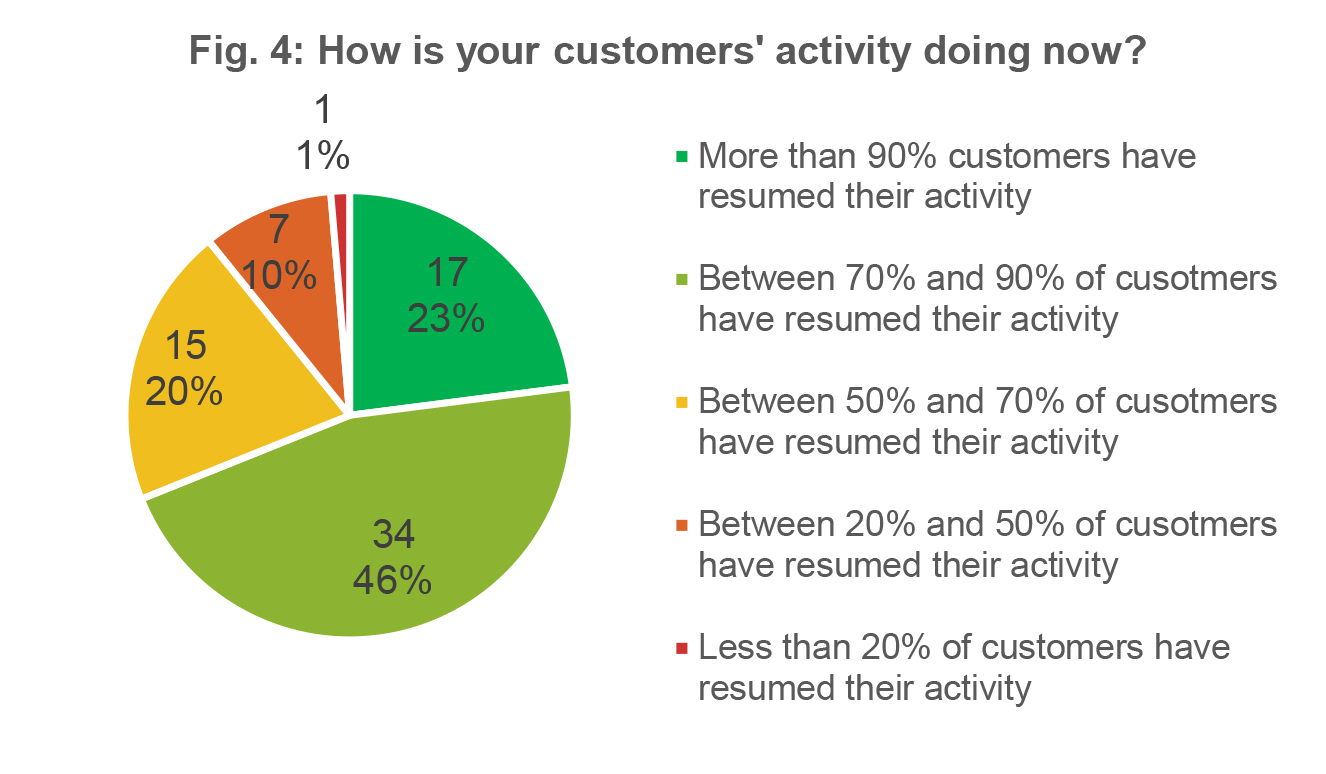

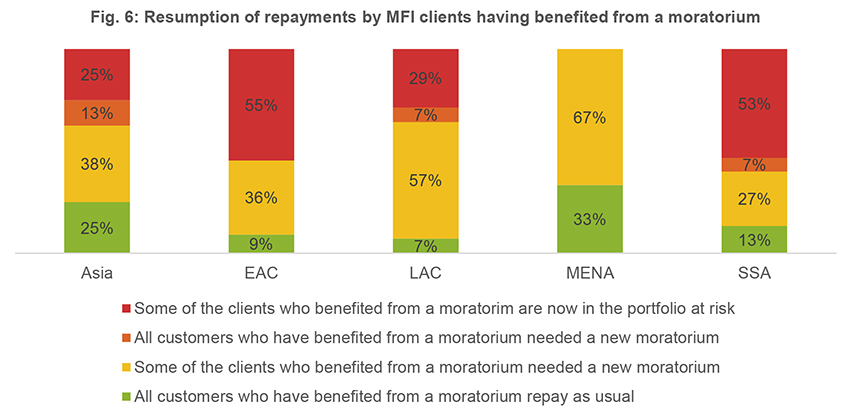

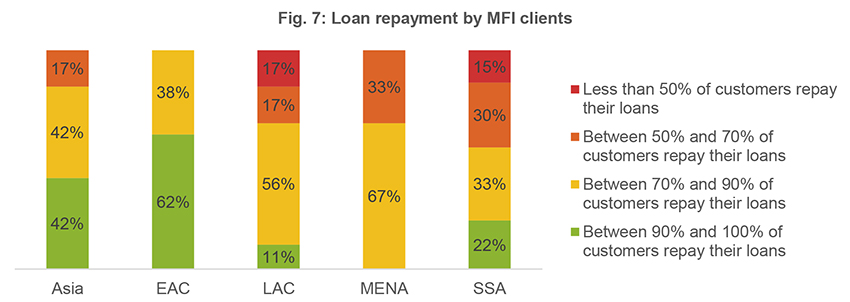

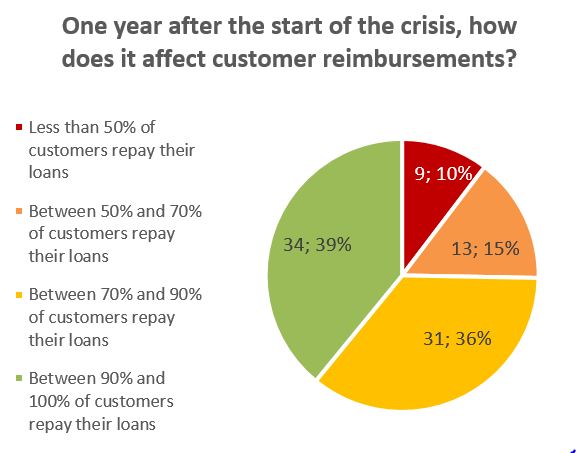

In parallel to these loan disbursement issues, credit risk remains the major challenge for 64% of our partner MFIs, as we have noted since the beginning of our survey series. While late repayments by customers may still be the result of ongoing moratoria (20% of respondents, particularly in South and Southeast Asia and Latin America and the Caribbean), the majority of moratoria exits have resulted in a shift from the “moratorium” portfolio to the “at risk” portfolio, either as unpaid loans or as restructured loans. In total, 61% of the respondents indicate that fewer than 90% of their customers are repaying their loans, and 25% are concerned by repayment rates below 70%.

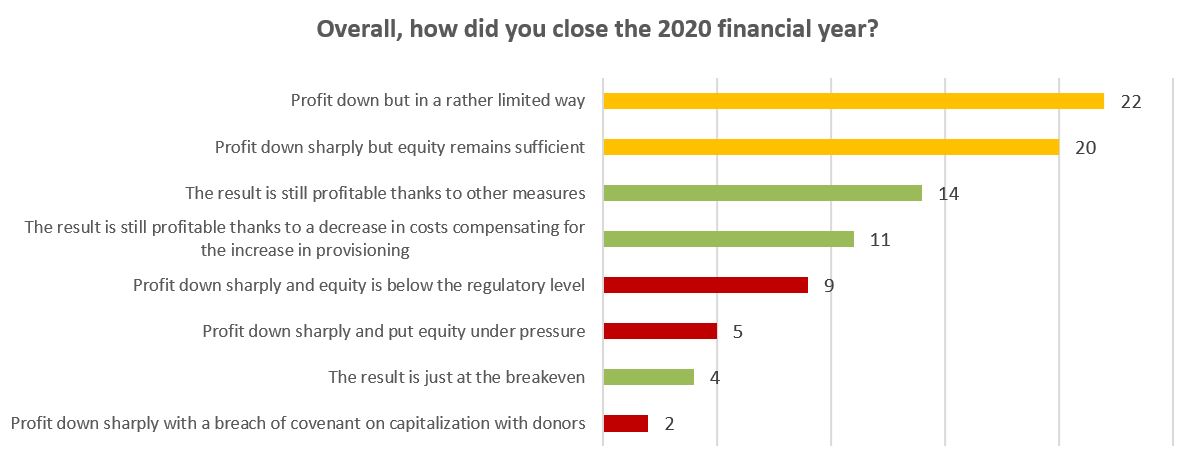

Another major difficulty is the decline in profitability of MFIs since the beginning of the COVID-19 crisis. At the end of Q1 2021, 55% of our partners raise this point. More specifically, we find that a share of the respondents managed to maintain some profitability in 2020, thanks to certain measures (33% – shown in green in the graph below). We then find a group of institutions (49% – shown in orange) for which an impact on profitability has been felt, but without endangering the institution. Finally, a last group stands out (18% – shown in red), in a less favourable position since the losses incurred in 2020 have direct consequences on the institutions’ own funds. For some of these institutions, this even implies that the company’s capital falls below the minimum levels required by the regulator or financiers.

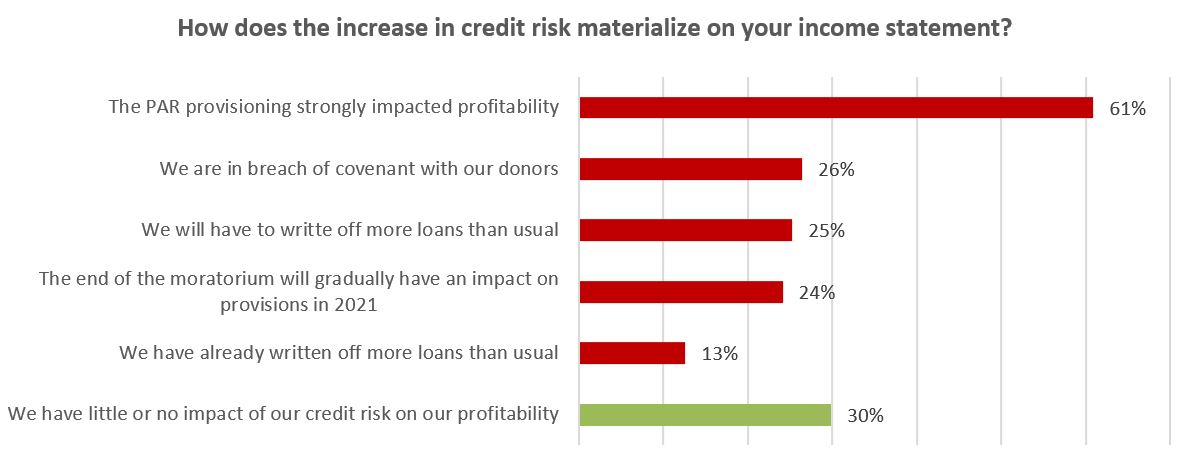

The provisioning of the portfolio at risk turns out to be the main factor impacting on profitability in fact (61%). For some institutions (26%), this may moreover have led to a breach of contract with their funders. At the same time, there are still few massive loan write-offs, as only 13% of respondents have already resorted to debt cancellation to a greater extent than in previous years.

The impact of credit risk on the profitability of the MFIs is nonetheless expected to continue in the coming months. Loan write-offs in high proportions, above the usual standards, should concern 25% of our partners surveyed. At the same time, 24% expect that the provisioning of the PAR, notably through the exit of the moratorium, will continue to have a strong impact on their financial results. Finally, it should be noted that the ageing of the current portfolio at risk could also lead to additional provisioning expenses.

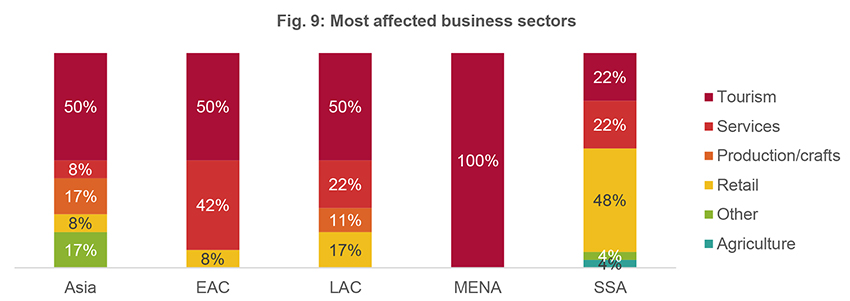

3. Strained equity capital leads to a search for investors

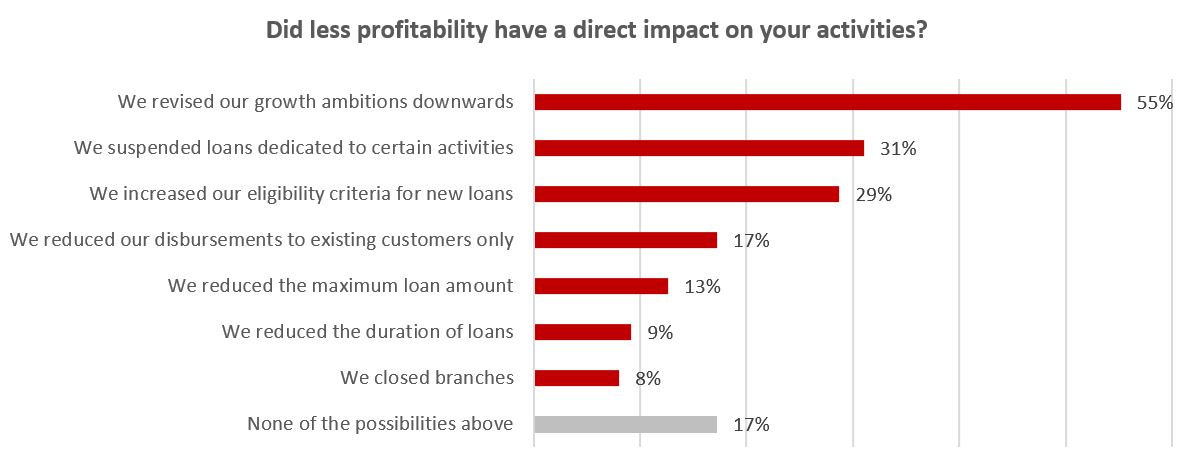

The decline in profitability, which could consequently continue in the near future without any improvement in credit risk, must be analysed for the short and long term. In the short term, controlling the portfolio at risk is a major challenge to avoid a (further) deterioration of profitability. This then has a direct impact on the operations of the MFIs. According to our partners, this observation has led the majority of the MFIs to revise their growth projections downwards (55%) for the coming years. It is also apparent that risk management involves paying particular attention to the type of activity of clients (31% have suspended disbursements to certain sectors – often tourism, international trade, etc.) and to eligibility criteria (29%). This increased caution reflects the current emphasis on risk management.

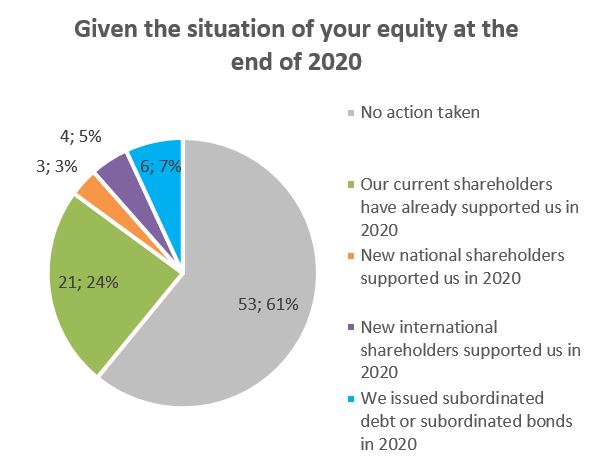

The other angle of reflection for the longer-term is the solvency of microfinance institutions in the face of declining revenues or losses. A majority of institutions today (61%) have not taken any action regarding their capital since the beginning of the crisis. Where this has been the case, existing shareholders have provided support to the MFIs, while subordinated debt (Tier 2 equity capital) has also been put in place, to a lesser extent.

The other angle of reflection for the longer-term is the solvency of microfinance institutions in the face of declining revenues or losses. A majority of institutions today (61%) have not taken any action regarding their capital since the beginning of the crisis. Where this has been the case, existing shareholders have provided support to the MFIs, while subordinated debt (Tier 2 equity capital) has also been put in place, to a lesser extent.

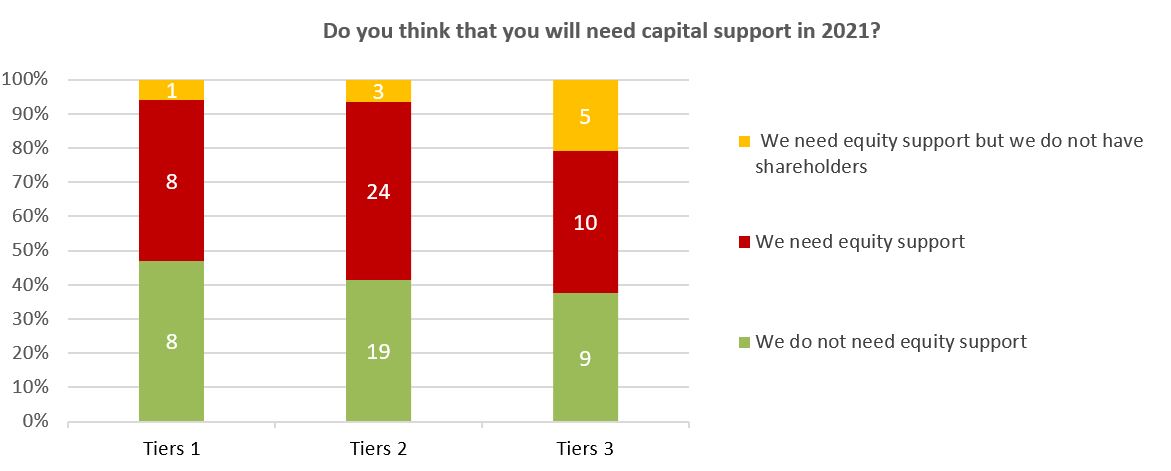

A very high proportion of these institutions (48%) nonetheless report an equity requirement in 2021. This sizeable proportion shows the extent of support needed within the sector to ensure its development. There is no real archetype of MFI that emphasizes this expectation of capital support in 2021: regardless of the size of the MFI, about half of each Tier category expresses capital needs.

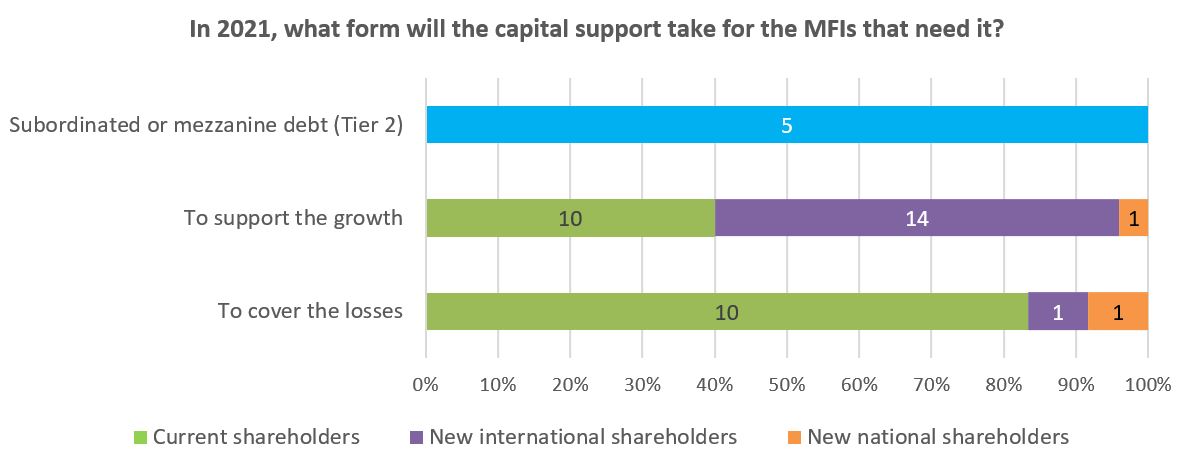

To meet these capital expectations, The types of shareholders that microfinance institutions wish to turn to in order to meet these capital expectations depend on the reason why this support is needed. For example, for institutions that mention a need for equity support in 2021, we find that when an MFI needs help to cover losses, it overwhelmingly turns to its existing shareholders (83% of cases, 10/12). Conversely, when MFIs are looking for support to continue to grow, they will more often turn to international investors (56% of cases, 14/25), beyond the potential contribution of existing shareholders. Finally, it is worth noting that subordinated debt may be favoured over capital injection, as this option is mentioned by 5 institutions.

All of our partners’ responses therefore suggest that the impact of the crisis, through credit risk, logically creates equity needs for a large proportion of entities, as they face either financial losses or a limitation in their ability to recover. While 41% of respondents say they will focus on improving the quality of their portfolio this year, our partners remind us of the essential role that international and existing investors will have to play in maintaining a satisfactory level of capitalisation that is conducive to their development.

_________________________________________________________________

(1) The results of the first five surveys are posted on //www.gca-foundation.org/observatoire-covid-19/, //www.ada-microfinance.org/fr/crise-du-covid-19/ and //www.inpulse.coop/news-and-media/

(2) Number of responding IMFs per region: EECA 22; SSA 25; LAC 22; SSEA 11; MENA: 7.

(3) Tier 1 means that the MFI manages a portfolio of over $50 million. Tier 2 applies to portfolios of $5 to $50 million, and Tier 3 concerns portfolios of less than $5 million.

Cross views: 2020, a year marked by the Covid-19 crisis

Jean-Marie Sander, Chairman of the Grameen Crédit Agricole Foundation until March 2021 and

Raphaël Appert, Chairman, Grameen Crédit Agricole Foundation, as of March 2021 and Vice-Chairman of Crédit Agricole SA and

Fédération Nationale du Crédit Agricole [National Federation of Crédit Agricole]

Just over 30 years ago, Michel Serres shared with us the need for a «Natural Contract» similar to the «Social Contract» which called for a reconciliation between man, nature and the living. 2020 was a terrible year for fragile economies.

The sound health of the Foundation, which has adapted to the economic effects of this crisis throughout the year, is not a mirror image of the dramas that have played out and are still playing out in the territories of our partners, where social shock absorbers are almost non-existent. Faced with the pandemic and its impact on daily life, family solidarity was often the rare relief very low-income populations could rely on.

Although its anthropocentric origin has yet to be demonstrated, this health crisis beckons us to become aware that we are part of nature, reminds us of our humility in the face of the natural order, and entrusts us with the task of not only developing but also of maintaining humanity.

The economic effects of the pandemic have affected the whole world but more particularly vulnerable populations: according to World Bank figures, 150 million people could be pushed rapidly into extreme poverty. For our part, we will avoid complacency about a probable ability to regain a semblance of economic growth, which we all know will not reach the most fragile populations quickly and evenly.

In this economic recovery, the Foundation will mobilise all its efforts in 2021, as there is still much to be done to try and change the mechanism that creates inequalities in the face of tragedy. We shall to that end have to rely on our professionalism, our determination and the values that guide our daily action.

It was with this ambition that we created the Foundation with Professor Yunus in 2008. It is still with this same ambition that we will continue to commit ourselves in the months to come.

Grameen Crédit Agricole Foundation’s role to respond to the crisis

Soukeyna Ndiaye Bâ has been a Director of the Foundation’s Board since its creation. Engaged in the promotion of women entrepreneurs for more than 20 years, she is also Executive Director of INAFI (International Network of Alternative Financial Institutions) a global network of organisations that support microfinance programmes. Abdul Hai Khan is a Foundation’s Director and the Managing Director of Grameen Trust. He is also Board member of diferent microfinance and social business organisations in Australia, Bangladesh, China, France, India, Kosovo, Italy, USA and Yemen.

1/ Directors of the Foundation, you are also both international experts and microfinance practitioners. Can you share with us your analysis of the crisis and more particularly on the territories that you know well?

Soukeyna Ndiaye Bâ: In Africa, the current toll is close to 100,000 deaths and more than 3.7 million people infected, but these figures do not reflect the reality in the continent because there is no mass screening due to a lack of resources. Because of restrictions and border closures to contain the pandemic, the economic crisis has not spared the African continent. In this context, small-scale entrepreneurs, smallholder farmers and informal sector workers are directly afected. On the front line: women, both in rural and urban areas, who are very active in the informal sector. In Senegal, for example, about 94% of women entrepreneurs operate in the informal sector. In rural areas, in addition to the gravity of the economic situation, the already alarming health precariousness and dificulty in accessing healthcare may worsen.

Abdul Hai Khan: Current death toll in Asia is approximately 417,000, while the number of infected cases stands at more than 26 million. Schools in East Asia and the Pacific have been completely closed for more than 25 million children for almost an entire year. Covid-19 has slowed growth in East Asia and the Pacific (EAP) as it has significantly reduced economic activity, including tourism and trade. Growth in the AEP region, excluding China, is forecast to slow to 1.3% in 2020 from 4.7% in 2019. Millions of households have been afected by the loss of jobs and income (including remittances), while they still have to cover basic expenses or service debt. Consequently, the percentage of poor people has increased.

2/ How do microfinance and social business mitigate the efects of the economic crisis?

AHK: By improving access to essential services, microfinance institutions and social businesses strengthen the resilience of low-income populations, including small-scale entrepreneurs from the formal and informal sectors and smallholder farmers. They are therefore essential to protect the most vulnerable populations, severely afected by the efects of the economic and health crisis during the Covid-19 pandemic. To cope with this pandemic, many microfinance institutions have innovated and increased their support to their clients. For example, they have restructured loans to better support the most afected clients and accelerated their digital transformation, by introducing or improving cashless transactions through mobile banking channels and by creating virtual branches.

3/ What is the outlook for the years to come?

AHK: The magnitude of the damage that Covid-19 pandemic has brought in the world is huge. However, it ofers us a unique opportunity to improve, or even redefine, our economic structures by relaying on social and environmental consciousness. We should not call it a ‘recovery’ programme but a ‘reconstruction’ programme. In this comprehensive reconstruction plan, social entrepreneurship can play an essential role, as it can be a lever to transform unemployed people into entrepreneurs. Financial inclusion can help economic recovery go hand in hand with social development.

SB: The world is threatened with recession and food and social crisis. Building the «after Covid» world must therefore be multi-sectoral and focused on innovation. We must learn from the problems encountered during this crisis: better assess and anticipate risks, strengthen our socio-economic models and rethink our public policies to better protect the most vulnerable populations. Women entrepreneurs will have a key role to play in boosting the economy. Supporting female entrepreneurship will be a lever for women empowerment and the development of rural and urban economies. Digital will be a major tool to encourage entrepreneurship, modernise, develop and innovate.

[Covid-19] The Grameen Crédit Agricole Foundation in 2020

Eric Campos, Grameen Crédit Agricole Foundation

In 2020, the Foundation supported 80 microfinance institutions and social enterprises in 39 countries around the world. With the Covid-19 pandemic, the Foundation established a permanent dialogue with all the partner organisations and adapted its financial and technical support. The Foundation also coordinated with other key players of the inclusive finance sectors to develop commun solutions and better protect the microfinance institutions and their clients. Spotlight on an interview to Eric Campos, Managing Director of the Foundation, and some key figures of the activity in 2020.

The Covid-19 crisis has affected the microfinance sector around the world

Eric Campos: 2020 has been a very challenging year for the partners of the Grameen Crédit Agricole Foundation, microfinance institutions and social environmental impact enterprises. Very trying because the final beneficiaries, who are very dependent on sectors such as trade, agriculture and craft, had to deal with lockdown measures and therefore had the greatest difficulty in developing their income generating activities.

The Foundation has adapted itself to better support entrepreneurs in the field

EC: The Foundation’s teams focused on all actions that could allow these institutions, these enterprises to save time and adapt to the economic effects of this crisis. At the international level, we coordinated an agreement with international funders to avoid a liquidity crisis in the microfinance sector. At the Foundation level, we have granted a number of rollovers, we have supported institutions and enterprises by organising technical assistance missions to enable them to improve on risk management and on treasury management. We have been present throughout this year, alongside our long-standing partner institutions of the Foundation.

What prospects for 2021?

EC: In 2021, we are still in a crisis context. We are seeing some small signs of economic recovery in about a third of the countries in which the Foundation operates. In 2021, the Foundation will strengthen its technical assistance programme. We will continue to finance our partners, to support them, and we are cautious but confident in the economic recovery that we are already starting to see. Our commitment: help our partners get through this global crisis.

One Year On: What a Year of Surveys Tell Us About Covid-19 and microfinance

Maxime Borgogno, Grameen Crédit Agricole Foundation

Spotlight on the interview of Maxime Borgogno for FinDev. Maxime is Investment Manager for the Asia and Central Europe region at Grameen Crédit Agricole Foundation.

Since the beginning of the pandemic, Grameen Crédit Agricole Foundation has been monitoring how the microfinance sector is responding to the crisis caused by Covid-19. One year later, what have you learned?

Maxime Borgogno : While the immediate consequences microfinance institutions (MFIs) faced were an increase in portfolio at risk and a reduction in their portfolio, the operational crisis did not lead to a total failure of the sector as feared at the beginning. In fact, we have seen many MFIs proactively adapting to the new context: they took adequate management measures while maintaining a responsible approach with their clients. Only a small proportion of surveyed institutions had to lay off staff during the crisis, and the ones in the most affected countries have successfully transitioned to remote systems. Most MFIs implemented loan restructuring to relieve affected clients. Some, especially in Southeast Asia, provided customers with emergency kits (food, sanitary equipment, etc.). They even explored new opportunities such as digital channels for loan repayment to adapt to the situation.

In general, MFIs remain optimistic about the future, based on a good understanding of current challenges and the experience built in 2020. While the crisis is not over and there are still challenges ahead, the sector has the capacity to meet them.

What are some of the key challenges that lie ahead? Why do you think the sector has the capacity to overcome them?

MB: The situation remains unpredictable and depends on the country. A MFI may come to face significant operational constraints very quickly, which will limit its activity. The latest data shows that nearly 75% of MFIs are facing a higher risk portfolio than before the crisis. Therefore, they will have to find a balance between carefully managing this risk while continuing to disburse new loans to their clients. It is now clear that the Covid-19 crisis has disrupted certain sectors, companies’ structures and ways of doing business. MFIs will need to account for these major changes in their strategy for the coming years.

Over the past year, we have seen MFIs remain fully committed to their social mission. They have proven their resilience and capacity to adapt during an unprecedented crisis. With poverty levels increasing due to the crisis, the mission of microfinance is more relevant than ever.

How did you monitor the situation over the past year?

MB: We launched the first monthly survey in March 2020 with 75 MFIs we support. The objective was to gather first impressions on the situation as well as the potential impact on their activities and their clients. In June 2020, we joined forces with ADA and Inpulse to expand the reach of the survey to more than 100 MFIs, including in Latin America and the Caribbean, where the Foundation does not have a presence. Since September, we have moved towards a quarterly format to avoid overloading the institutions in a period of resumption of their activities. The next survey will be in March.

The survey results, as well as other articles related to the Covid-19 crisis, are available on The Covid-19 Observatory, a space created by the Foundation at the onset of the pandemic.

Microfinance institutions often don’t have the capacity to respond to surveys, especially when they have a major crisis to deal with. What helped you to continue gathering data among them?

MB: From the very beginning, we chose not to ask MFIs detailed financial information, but rather to gather their impressions and observations on the impact of the crisis. We deliberately kept the number of questions low and made sure they were as clear as possible. We also avoided requesting the same information they send us in their regular monthly reports.

We insist on a high level of communication with our partners, so we share the results of the surveys with them as soon as they are available and remain open to their feedback in this process. Comments from our respondents have helped us to adapt the wording of the questions and the content of the questionnaire. We believe that their involvement in the process is a key motivator for our partner MFIs to continue participating in the survey.

How do you see this crisis shaping the future of microfinance? Are you worried about the future of the sector?

MB: 2020 was a historic year that demonstrated the resilience of the microfinance sector. MFIs innovated and strengthened their services to protect their clients. At the same time, lenders and other stakeholders coordinated among themselves to adopt the most suitable measures to support MFIs. The last survey we conducted on the impact of the Covid-19 crisis reveals that most institutions expect their activity to grow in 2021, in terms of both portfolio volume and number of clients.

However, many of the most affected institutions will need support from their shareholders and lenders. As credit risk gradually translates into losses in 2021, the responsiveness of investors will be fundamental and is a forthcoming topic for the Foundation’s Covid-19 Observatory.

The crisis is not yet behind us, but we are encouraged for the future of the sector. Digital transformation, coordination between stakeholders and innovation will be essential to strengthen the resilience and impact of microfinance.

Source: FinDev

Ugafode and the financial inclusion for refugees

Supported by the Grameen Crédit Agricole Foundation since 2015, UGAFODE Microfinance Limited is a microfinance institution that offers inclusive financial and non-financial services to low income, but economically active populations in Uganda. UGAFODE is one of the three organisations supported by a programme launched by the Foundation, The Swedish International Development Cooperation Agency (Sida) and the UN Refugee Agency to support the financial inclusion of refugees. Thanks to the financial and technical support, UGAFODE opened a branch in Nakivale Refugee Settlement in Uganda. Spotlight on an interview to Shafi Nambobi, CEO of UGAFODE.

1. In a few words, what is UGAFODE Microfinance Limited?

UGAFODE Microfinance Limited began in 1994 as an NGO focused on group credit for women and has since transformed into a Microfinance deposit-taking institution regulated by Bank of Uganda. The institution specifically targets low income but economically active population in the country through 7 urban and 12 rural branches, serving over 110,000 savings customers and 8,000 loan clients. We offer a variety of financial services, which include savings, loans and money transfer services with a loan portfolio of €12.1 million and savings volume of €6 million.

2. UGAFODE received an innovative support from the Grameen Crédit Agricole Foundation, the Swedish International Development Cooperation Agency (Sida) and the UN Refugee Agency in 2019, when it was selected as beneficiary of a programme to support financial inclusion for refugees. Can you explain the initiative and the support UGAFODE received?

Most of the refugees have been discriminated against and denied credit facilities from financial institutions as they are viewed to be too risky, despite being engaged in agriculture plus retail trade and commerce. In March 2020, UGAFODE was the first financial services institution to set up a physical branch in a refugee settlement in Uganda thanks to the programme. Nakivale refugee settlement is the 8th largest in the world hosting over 134,000 refugees from 13 countries. The total project budget is €536,780 with €396,882 coming from Sida and €139,810 contributed by UGAFODE in three years. Furthermore, the Foundation also granted a new loan of €540,000 in July 2020, of which 50% will be used in the framework of the refugees programme, to lend to refugees and host populations.

3. What are the first outcomes of the project?

Clearly, the project has passed the proof-of-concept stage. Since the opening of the Nakivale’s branch, 505 loans totalling to €383,596 have been disbursed between 2nd March 2020 and 31st December 2020, mainly to support small and medium enterprises and agriculture individual loans. It is important to note that all this has been achieved under Covid-19 crisis. The Portfolio At Risk (PAR) is at 1.65% for 1 day and 0% for 30 days, which is remarkable and appreciated. Moreover, we have reach over 5,000 refugees with financial literacy messages and 2,534 clients have opened savings with a total of €65,112. A total of 5,301 refugees have received €776,345 through money transfer services from friends and relatives at the Nakivale branch in the nine months since the branch was opened. We currently employ 21 staff with 8 refugees at Nakivale plus 4 in the Call Centre in Kampala to manage customer complaints in the major refugee languages.

4. How did Covid-19 pandemic affect the project? What measures have been taken to face the crisis?

The project implementation and opening of the branch happened at the beginning of the Covid-19 crisis. Fortunately, as government rendered financial services as essential, the Nakivale branch was able to offer needed services to the settlement clients on a very positive note. UGAFODE has been able to adjust its policies and procedures to serve refugees within the regulation guidelines. We recruited refugee staff at the Call Centre to provide guidance and information to the clients. We also built a branch extension to provide sufficient space to ensure safety of both staff and customers. Furthermore, we granted rescheduling options to the clients with loans to support them in this period of crisis. The Grameen Crédit Agricole Foundation and KIVA supported us to face the crisis. The Foundation granted us flexible budget lines within core lines to cater for crisis’ uncertainties. The Branch operates under strict COVID 19 SOPs (Standard Operating Procedures) instituted by the Ministry of Health and Government. We will also be able to buy 3 more motorcycles to enable the branch staff reach out to more clients, easily and faster.

5. What are now the priorities of the project?

There are three priorities :

- Scale up financial literacy trainings to raise awareness of at least 8,800 refugees and 8,000 host communities in year 2 and 15,500 refugees and 14,000 host communities in the last year of the project.

- Conduct a customer survey to facilitate informed decisions and develop products tailored to refugees.

- Roll out the project model to other settlements. After Nakivale, the project is going to be replicated to other refugee settlements at the earliest. Initial feasibility studies have been conducted for Kyaka, Kyangwali and Rwamwanja refugee settlements.

OXUS Kyrgyzstan and its six commandments for the Covid-19 crisis

Interview with Denis Khomyakov, CEO, OXUS Kyrgyzstan

Since the beginning of the Covid-19 crisis, the Grameen Crédit Agricole Foundation has worked on several initiatives to better support the microfinance sector. OXUS Kyrgyzstan is one of the microfinance institutions that has benefited from the Foundation’s response to the crisis. Five questions to Denis Khomyakov, CEO of OXUS Kyrgyzstan (OKG)

____________________

The Covid-19 crisis has strongly influenced Kyrgyzstan’s economy and your organisation. What measures have you adopted to cope with it?

The crisis has hit the economy and the health system of Kyrgyzstan hard. With border closures and lockdowns, industry and agriculture declined, and transport services collapsed. Although new activities emerged (such as delivery services), Covid-19 affected the country’s economy and by extension our clients and business.

In this context, we were well prepared at OKG. As early as February, we first protected our staff with home-based work or short time working at 2/3 of the salary; which involved the digitalisation of our activities. In May, we adopted both remote and on-site work, thanks to the required anti-Covid measures foreseen in the Covid-19 Business Continuity Plan (BCP), which quickly became operational.